Sometimes it’s hard to understand how some scams work or why criminals would even try them on you.

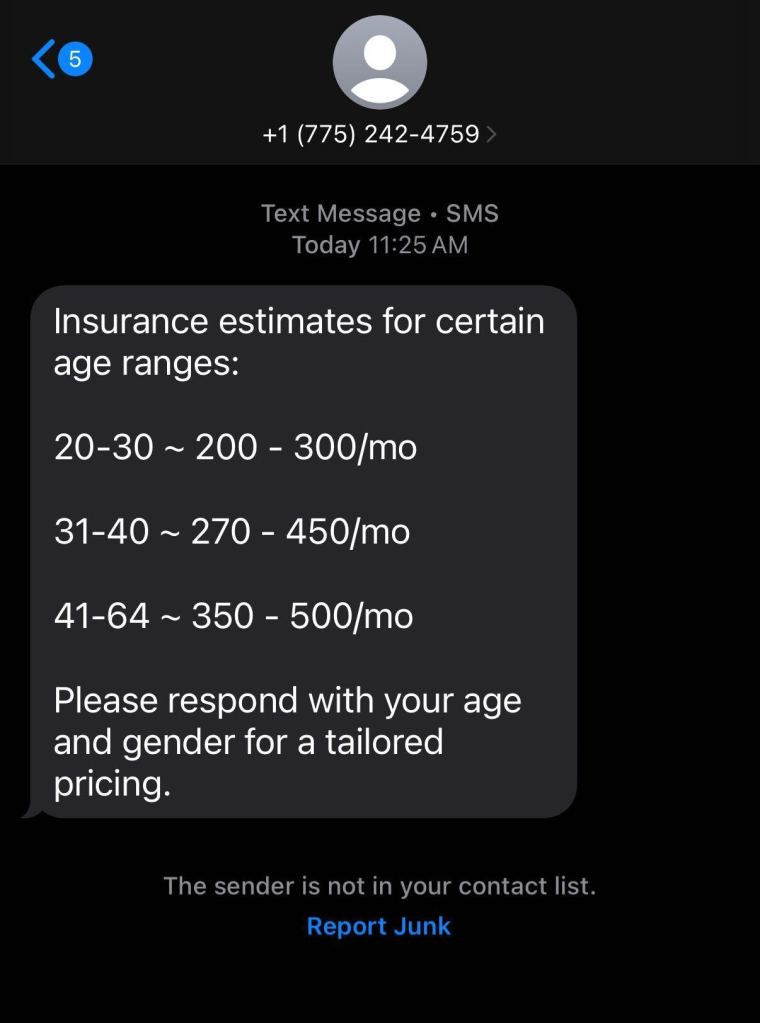

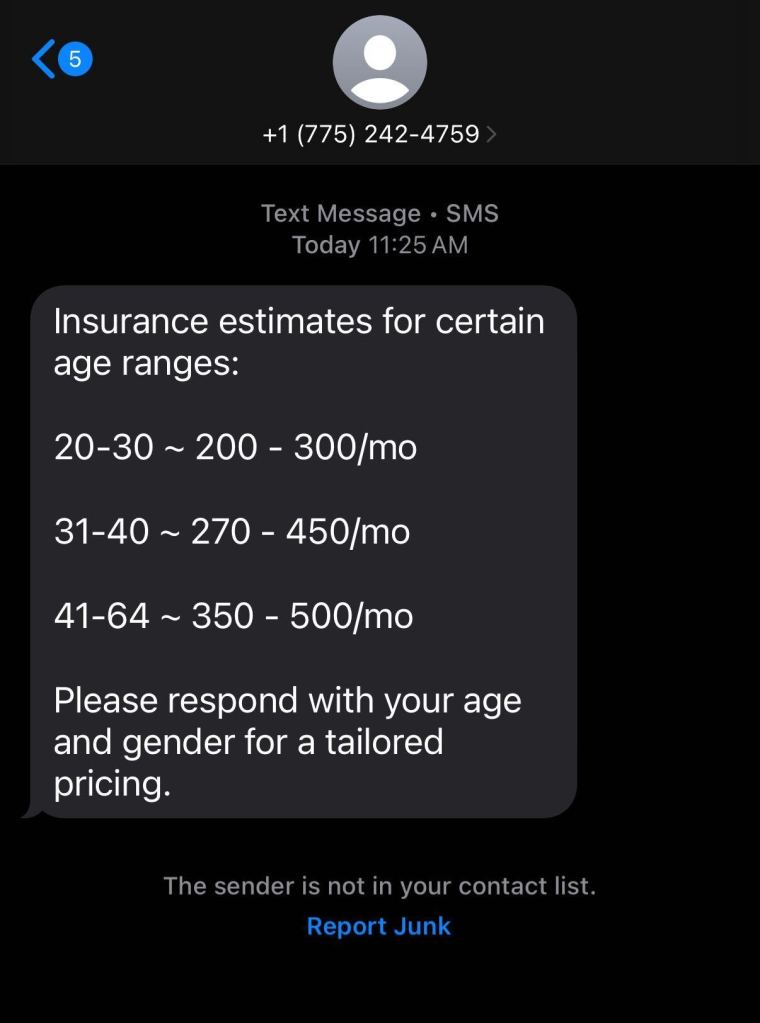

In this case it may have been a matter of timing. One of my co-workers received this one:

“Insurance estimates for certain age ranges:

20-30 ~ 200 – 300/mo

31-40 ~ 270 – 450/mo

41-64 ~ 350 – 500/moPlease respond with your age and gender for a tailored pricing.”

A few red flags:

- No company name

- Unsolicited message from an unknown number

- They ask for personal information (age, gender)

First off, don’t respond to this kind of message, not even to tell them to get lost. A reply tells the scammer that the number is “responsive,” which only encourages more texts.

And if you provide the sender with the personal details they ask for, those can be used later for social engineering, identity theft, or building a profile for future scams.

How these insurance scams work

Insurance scams fall into two broad groups: scams targeting consumers (to steal money or data) and fraud against insurers (fake or inflated claims). Both ultimately raise premiums and can expose victims to identity theft or legal trouble. Criminals like insurance-themed lures because policies are complex, interactions are infrequent, and high-value payouts make fraud profitable.

Here, we’re looking at the consumer-focused attacks.

Different criminal groups have their own goals and attack methods, but broadly speaking they’re after one of three goals: sell your data to other criminals, scam you out of money, or steal your identity.

Any reply with your details usually leads to bigger asks, like more texts, or a link to a form that wants even more information. For example, the scammer will promise “too good to be true” premiums and all you have to do is fill out this form with your financial details and upload a copy of your ID to prove who you are. That’s everything needed for identity theft.

Scammers also time these attacks around open enrollment periods. During health insurance enrollment windows, it’s common for criminals to pose as licensed agents to sell fake policies or harvest personal and financial information.

How to stay safe from insurance scams

The first thing to remember is not to respond. But if you feel you have to look into it, do some research first. Some good questions to ask yourself before you proceed:

- Does the sender’s number belong to a trusted organization?

- Are they offering something sensible or is it really too good to be true?

- When sent to a website, does the URL in the address bar belong to the organization you expected to visit?

- Is the information they’re asking for actually required?

You can protect yourself further by:

- Keeping your browser and other important apps up to date.

- Use a real-time anti-malware solution with a web protection component.

- Consult with friends or family to check whether you’re doing the right thing.

After engaging with a suspicious sender, use STOP, our simple scam response framework to help protect against scams.

- Slow down: Don’t let urgency or pressure push you into action. Take a breath before responding. Legitimate businesses, like your bank or credit card provider, don’t push immediate action.

- Test them: If you’re on a call and feel pressured, ask a question only the real person would know, preferably something that can’t easily be found online.

- Opt out: If something feels wrong, hang up or end the conversation. You can always say the connection dropped.

- Prove it: Confirm the person is who they say they are by reaching out yourself through a trusted number, website, or method you have used before.

Pro tip: You can upload suspicious messages of any kind to Malwarebytes Scam Guard. It will tell you whether it’s likely to be a scam and advise you what to do.

We don’t just report on threats—we help safeguard your entire digital identity

Cybersecurity risks should never spread beyond a headline. Protect your, and your family’s, personal information by using identity protection.