Imperva的Client-Side Protection工具通过新增功能帮助组织应对PCI DSS 4.0要求,包括自动化合规报告、智能脚本授权、实时监控和警报、强化执行控制等,简化合规流程并提升支付页面安全性。 2025-9-30 19:47:21 Author: securityboulevard.com(查看原文) 阅读量:0 收藏

When the latest PCI DSS 4.0 requirements came into full effect in March 2025, organizations processing cardholder data faced new obligations to protect payment pages from client-side risks. Requirements such as 6.4.3 (script inventory, authorization, and integrity monitoring) and 11.6.1 (detection of unauthorized changes) demanded stronger visibility and control than many teams had in place.

First launched in 2020, Imperva Client-Side Protection (CSP) helps organizations defend against supply-chain attacks such as Magecart, formjacking, and digital skimming. With a major update in January 2025, CSP introduced new PCI DSS-focused capabilities along with guidance to support compliance efforts. Since then, we’ve added further enhancements to streamline audits, reduce operational overhead, and provide security and compliance managers with greater peace of mind.

Below, we’ll walk through the newest CSP capabilities and how they streamline your PCI journey.

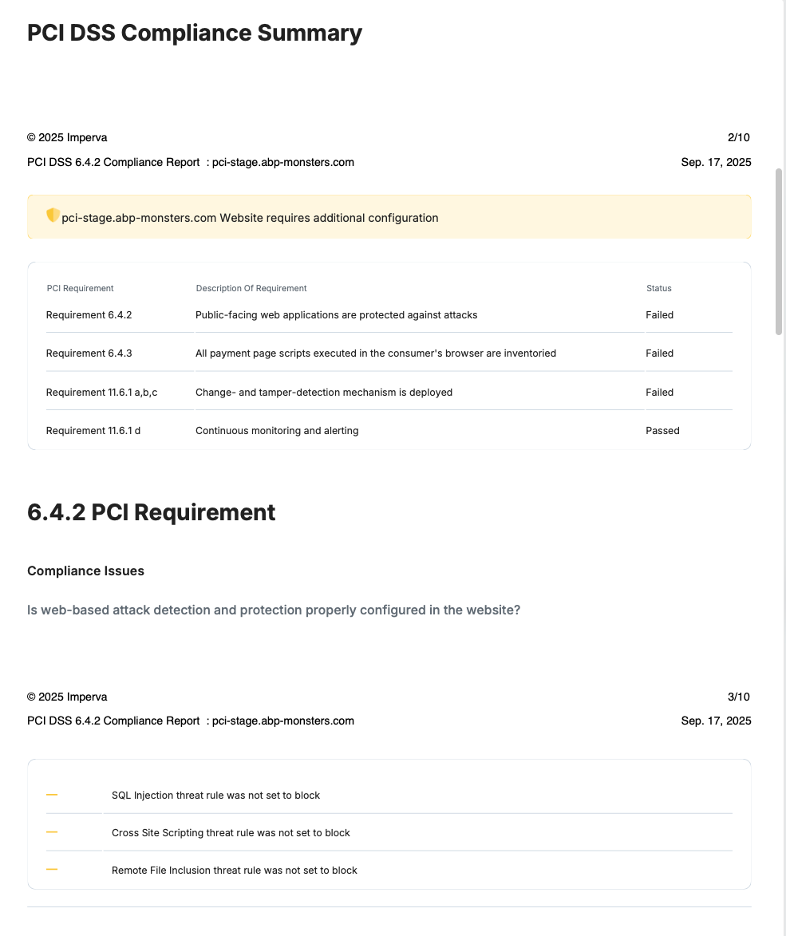

Exportable PCI Compliance Report: Prove Compliance with Confidence

One of the most time-consuming aspects of PCI audits is evidence gathering. To eliminate this burden, Imperva now provides an Exportable PCI Report directly within CSP.

- Includes detailed explanations of how CSP enforces PCI DSS 6.4.3 and 11.6.1.

- Consolidates CSP and CWAF (Cloud Web Application Firewall) data into a single document to help with PCI-DSS 6.4.2.

- Provides auditors with proof that all payment pages are monitored, scripts are authorized, and integrity checks are continuously enforced.

This single export helps customers demonstrate compliance quickly and confidently turning audits from a stressful process into a streamlined checkbox.

Smarter Script and Domain Authorization

Meeting PCI DSS requirements for script authorization and justification requires precision. We’ve expanded the ways customers can approve, manage, and inherit script status:

- Pre-Approved Domains for Paths: Apply domain approvals not only to your main site but also to individual onboarded paths, reducing the risk of accidentally blocking trusted resources.

- Pre-Approved Scripts with Authorized Status: Preauthorizing a script now updates both the Enforcement header and the status in CSP to “Authorized,” cutting down manual configuration work.

- APIs for Scripts Requiring Reauthorization: A new newVersionSinceAuth field flags when a script has changed since it was last approved, enabling faster re-review cycles.

- PCI Authorizer User Permission: Assign app developers or compliance staff a scoped role with just the right privileges—authorize scripts, pre-approve domains, subscribe to reports—without granting full enforcement control.

Together, these improvements ensure your PCI obligations are met while reducing the effort needed to keep approvals current.

Expanded Monitoring and Alerting

PCI DSS 11.6.1 emphasizes the need to detect unauthorized modifications in near real-time. CSP now provides more granular alerting and monitoring options, so teams are never caught off guard:

- New Script and Data Transfer Alerts: Get notified by email or SIEM when new scripts or outbound transfers are discovered.

- Malicious Domain Alerts: Immediate alerts when Instant Block automatically prevents communication with a known malicious domain. If Instant Block is disabled, the alert recommends enabling it.

- Clarified “Unhealthy Header” Status: CSP now explains exactly why a Content-Security-Policy header is marked unhealthy and provides actionable steps to remediate.

These improvements keep security and compliance teams proactive, closing gaps long before auditors or attackers find them.

Stronger Enforcement Controls

Enforcement is at the heart of PCI DSS client-side requirements. We’ve made it easier and faster to block unwanted behaviors across dynamic and complex environments:

- Instant Block Enhancements: Now supports wildcard domains and records all toggle activity in the audit trail for accountability.

- Unsafe Directive Revamp: Customers can granularly select which unsafe directives to retain or remove during Monitor mode testing.

- Nonce Passthrough: Allows customers to pass nonce values from their origin servers into CSP, ensuring compatibility with modern CSP header practices.

- Dynamic Script Details: Customers now see exactly how CSP will treat dynamic scripts with wildcards in the middle of URLs, eliminating enforcement surprises.

By combining speed, flexibility, and transparency, these updates reduce risk without disrupting business operations.

Usability Enhancements for Complex Web Environments

Not all websites are straightforward. Payment pages often live deep within large, distributed applications. CSP now supports more granular onboarding and simulation workflows to match real-world complexity:

- Dynamic Path Onboarding: Onboard paths that start with or end with specific URL patterns, dramatically reducing the number of paths to manage.

- Simulation Mode With Multiple IPs: Test enforcement scenarios across up to five IP addresses simultaneously. Active simulation IPs are clearly shown in the console.

These improvements let security teams model enforcement safely and at scale, avoiding surprises in production.

Streamlining Compliance, Protecting Customers

Every one of these enhancements is designed with two goals in mind:

- Make PCI DSS 4.0 compliance easier to achieve and prove. From the exportable PCI report to the Compliance Dashboard, CSP eliminates ambiguity and helps you walk into audits fully prepared.

- Strengthen client-side security against real threats. From malicious domain alerts to instant blocking of wildcard domains, these features don’t just tick compliance boxes—they actively defend customers from fraud and data exfiltration.

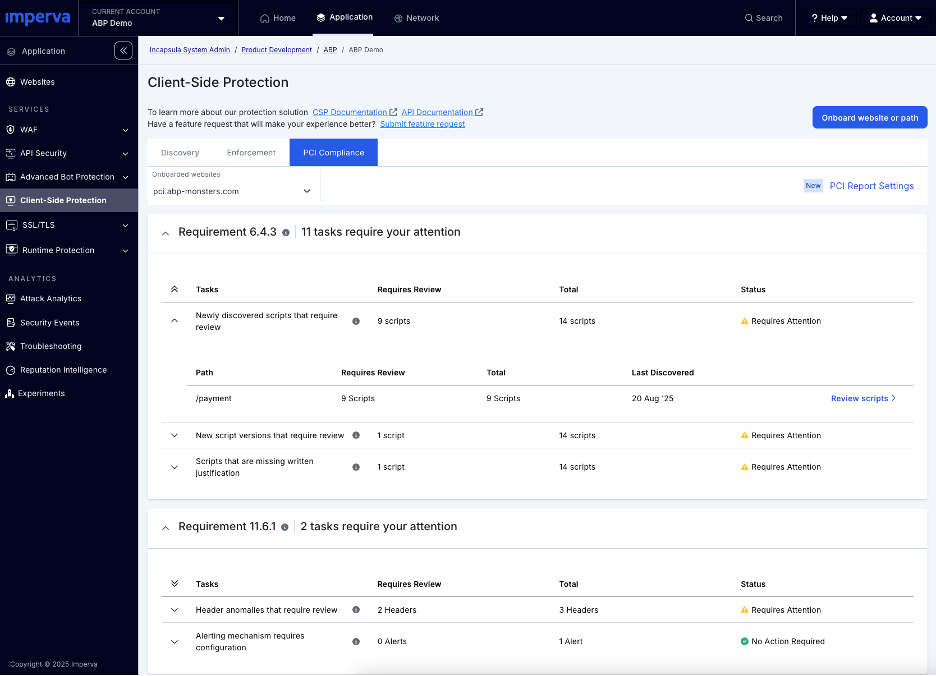

The PCI compliance dashboard below provides customers with easy next steps for their audit.

Imperva Client-Side Protection continues to evolve alongside PCI DSS and the client-side threat landscape. By giving compliance managers greater visibility, control, and reporting, we ensure that protecting sensitive payment data is not only possible but efficient.

Safeguard Cardholder Data and Simplify PCI Compliance

Imperva CSP prevents data theft from client-side attacks like formjacking, Magecart, and digital skimming while helping you meet the latest PCI DSS 4.0 requirements. With these latest enhancements, organizations can:

- Prove compliance quickly with exportable reports.

- Minimize manual work through smarter authorization workflows.

- Stay ahead of threats with real-time alerts.

- Confidently enforce policies across dynamic, complex environments.

Start simplifying PCI compliance today with Imperva Client-Side Protection.

The post Imperva Enhances Client-Side Protection to Help You Stay Ahead of PCI-DSS Compliance appeared first on Blog.

*** This is a Security Bloggers Network syndicated blog from Blog authored by Grainne McKeever. Read the original post at: https://www.imperva.com/blog/imperva-enhances-client-side-protection-to-help-you-stay-ahead-of-pci-dss-compliance/

如有侵权请联系:admin#unsafe.sh