诈骗推动了欺诈预防的第二次进化。传统账户、身份和设备检查无法有效应对社会工程学诈骗。行为分析通过多模型检测异常行为和已知 scam 模式,并结合设备风险和威胁情报提升检测能力。 2025-3-13 10:16:44 Author: www.threatfabric.com(查看原文) 阅读量:4 收藏

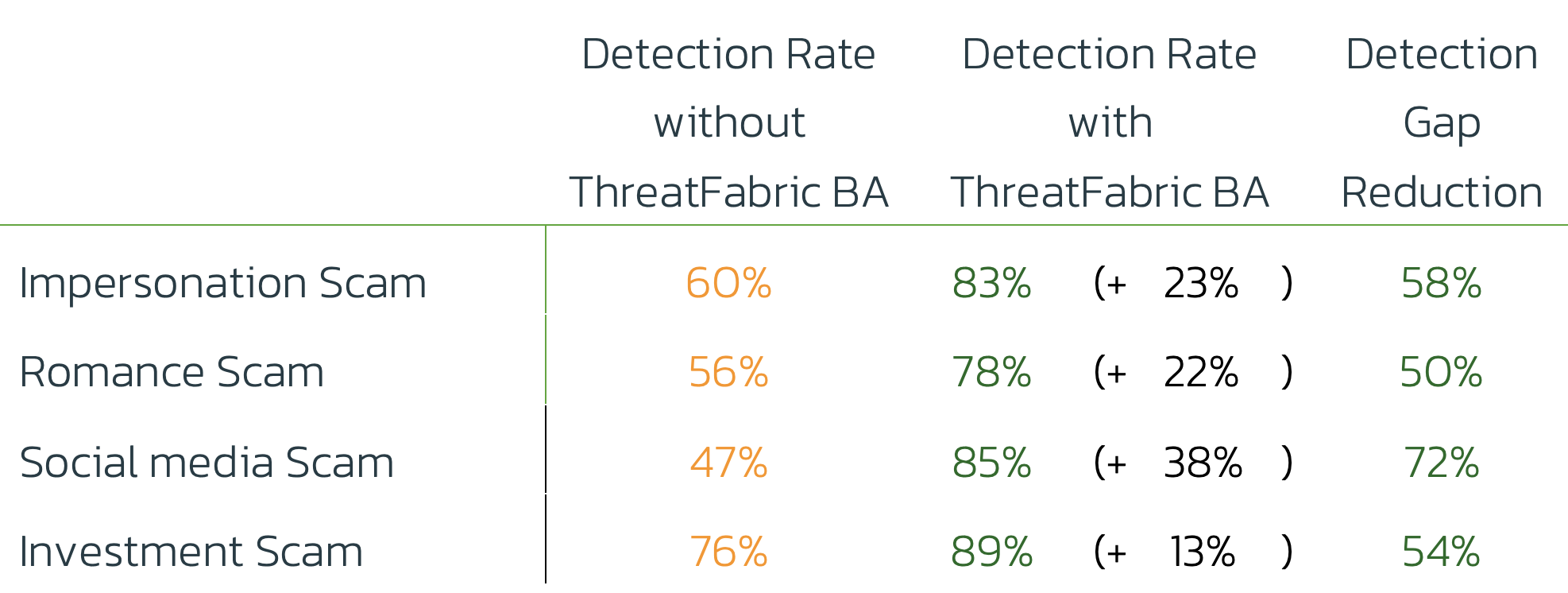

First, we couldn’t trust credentials anymore. Figure 1: Evolution of fraud prevention Behavioral Analytics provides the ability to translate behavioral customer journey events in risk scores. BA takes events from the customer journey, and data like timings, keystrokes, swipes, journey triggers, taps or clicks, and models them. A Multi-Model approach is Figure 2: Multiple AI models The Identity model is individual. It checks for deviations from a user’s regular modelled behavior: The Baseline Fraud Model is federated, and checks for matches against known scam Modus Operandi, including (but not limited to): Scam- related behavioral events happen throughout the customer journey, from App / Web start to transaction signing. That’s why we often say: Scams don’t start with a transaction; they end with one. Figure 3: Behavioral indicators in the Customer Journey Scam Detection benefits tremendously from adding Behavioral Analytics. Our most recent measurements for the most common scams show the following increases: Figure 4: Detection Rate increases Behavioral Analytics is made for detecting scams. The nature of Social Engineering does not translate into technical TTPs and scores easily. Modelling behavioral allows Fraud Prevention teams to tie risk scores to behavior. Behavioral Analytics provides a tremendous boost of detection rates of scams. As we will see later in this series, this power is even greater when synergizing with Device Risk and Threat Intelligence. At ThreatFabric, we’ve solved some key issues with legacy Behavioral technology: Figure 5: Behavioral and Device Technology in the Customer Journey

Then, we couldn’t trust devices anymore.

Now, we can’t trust behavior anymore.“

Scams (or Authorized Push Payments) are the catalyst of a second evolution in fraud prevention. When a scam happens, traditional Account, Identity and Device checks are often insufficient detection mechanisms. After all, scams almost exclusively leverage social engineering. Victims are convinced to transfer funds to a fake family member or a fake “safe account”.

Behavioral Analytics & Scams

Applying Behavioral Biometrics to the Customer Journey

Detection Rates

Verdict: Behavioral Analytics and Scams get along tremendously well

Behavioral Analytics and ThreatFabric

如有侵权请联系:admin#unsafe.sh