Table of LinksAbstract1 Introduction2 Mathematical Arguments3 Outline and Preview4 Calvo Framew 2024-12-7 04:1:29 Author: hackernoon.com(查看原文) 阅读量:0 收藏

Table of Links

4 Calvo Framework and 4.1 Household’s Problem

4.3 Household Equilibrium Conditions

4.5 Nominal Equilibrium Conditions

4.6 Real Equilibrium Conditions and 4.7 Shocks

5.2 Persistence and Policy Puzzles

6 Stochastic Equilibrium and 6.1 Ergodic Theory and Random Dynamical Systems

7 General Linearized Phillips Curve

8 Existence Results and 8.1 Main Results

9.2 Algebraic Aspects (I) Singularities and Covers

9.3 Algebraic Aspects (II) Homology

9.4 Algebraic Aspects (III) Schemes

9.5 Wider Economic Interpretations

10 Econometric and Theoretical Implications and 10.1 Identification and Trade-offs

10.4 Microeconomic Interpretation

Appendices

A Proof of Theorem 2 and A.1 Proof of Part (i)

B Proofs from Section 4 and B.1 Individual Product Demand (4.2)

B.2 Flexible Price Equilibrium and ZINSS (4.4)

B.4 Cost Minimization (4.6) and (10.4)

C Proofs from Section 5, and C.1 Puzzles, Policy and Persistence

D Stochastic Equilibrium and D.1 Non-Stochastic Equilibrium

D.2 Profits and Long-Run Growth

E Slopes and Eigenvalues and E.1 Slope Coefficients

E.4 Rouche’s Theorem Conditions

F Abstract Algebra and F.1 Homology Groups

F.4 Marginal Costs and Inflation

G Further Keynesian Models and G.1 Taylor Pricing

G.3 Unconventional Policy Settings

H Empirical Robustness and H.1 Parameter Selection

I Additional Evidence and I.1 Other Structural Parameters

I.3 Trend Inflation Volatility

4.5 Nominal Equilibrium Conditions

Nominal rigidity generates real distortions through the dispersion term. The demand aggregator

represents price dispersion since

Proposition 3. ∆ is second order when approximated from ZINSS.

The first result is a global property of price dispersion, which will be called upon when analyzing the boundary conditions in the fixed-point theorem. The second is a local condition that justifies the √ ε limiting construction. Neither result is novel so proofs are relegated to Appendix B.3. The intuition is that consumers prefer variety and it is therefore costly to substitute between high and low price goods. Therefore they cannot achieve the same utility when prices are dispersed which will always arise when prices are rigid and inflation variable. Here with Calvo pricing, ∆ evolves according to the following relationship:

Using Proposition 1, I can solve for the reset price to give a recursion in inflation

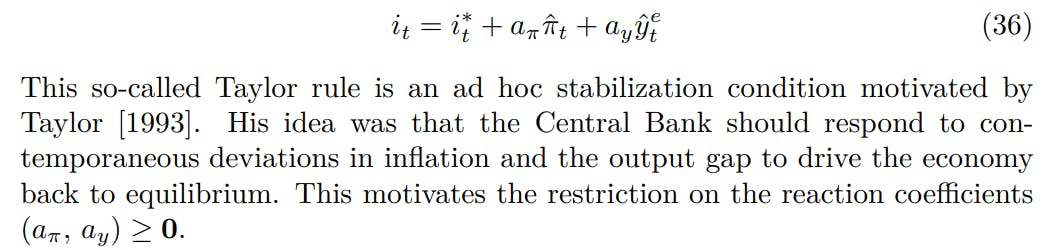

Finally, there is the monetary policy rule.

When selecting such a simple rule, my key concerns were tractability and comparability with previous work. In the next part, I confirm that including lags or leads would not be justified by welfare concerns in a purely forward-looking model. This fits with my ultimate goal of justifying inertial policy from an optimal policy standpoint. My policy analysis should prove immune to timing issues and information available to the Central Bank. This is because the boundary case of inactivity is common to all possible policy rules, whilst in a persistent stochastic setting even the expectations of future variables would induce inertia.[26]

26Taylor’s actual proposal was somewhat closer to my analysis. His rule used an inflation measure averaged over the previous four quarters. Although, his motivation was different, he envisaged that the lagged inflation rate would serve as a proxy for expected inflation. In the same conference (Henderson and McKibbin [1993]) came up with a very similar formulation.

Author:

(1) David Staines.

如有侵权请联系:admin#unsafe.sh