2024-12-7 04:2:46 Author: hackernoon.com(查看原文) 阅读量:2 收藏

Table of Links

4 Calvo Framework and 4.1 Household’s Problem

4.3 Household Equilibrium Conditions

4.5 Nominal Equilibrium Conditions

4.6 Real Equilibrium Conditions and 4.7 Shocks

5.2 Persistence and Policy Puzzles

6 Stochastic Equilibrium and 6.1 Ergodic Theory and Random Dynamical Systems

7 General Linearized Phillips Curve

8 Existence Results and 8.1 Main Results

9.2 Algebraic Aspects (I) Singularities and Covers

9.3 Algebraic Aspects (II) Homology

9.4 Algebraic Aspects (III) Schemes

9.5 Wider Economic Interpretations

10 Econometric and Theoretical Implications and 10.1 Identification and Trade-offs

10.4 Microeconomic Interpretation

Appendices

A Proof of Theorem 2 and A.1 Proof of Part (i)

B Proofs from Section 4 and B.1 Individual Product Demand (4.2)

B.2 Flexible Price Equilibrium and ZINSS (4.4)

B.4 Cost Minimization (4.6) and (10.4)

C Proofs from Section 5, and C.1 Puzzles, Policy and Persistence

D Stochastic Equilibrium and D.1 Non-Stochastic Equilibrium

D.2 Profits and Long-Run Growth

E Slopes and Eigenvalues and E.1 Slope Coefficients

E.4 Rouche’s Theorem Conditions

F Abstract Algebra and F.1 Homology Groups

F.4 Marginal Costs and Inflation

G Further Keynesian Models and G.1 Taylor Pricing

G.3 Unconventional Policy Settings

H Empirical Robustness and H.1 Parameter Selection

I Additional Evidence and I.1 Other Structural Parameters

I.3 Trend Inflation Volatility

5.2 Persistence and Policy Puzzles

This subsection begins with observations concerning the stochastic properties or lack thereof of the Phillips curve. I lay out Divine Coincidence. When I add suitable error terms, I am able to extend these results to rule out persistence. Moreover, under a different plausible timing condition there can be no meaningful policy change so optimal policy implements laissez-faire. The second subsection shows that these properties extend to non-linear approximations either directly or under a suitable special case.

5.2.1 Linearization

Remark 4. The New Keynesian Phillips curve (53) and (54) is stochastically singular. It cannot be statistically estimated without an additional non-structural disturbance i.e. unrelated to model primitives. This justifies the criticism of "dubious structural shocks" by Chari et al. [2009] in particular the role ascribed to mark-up shocks in the Phillips curves of leading New Keynesian models based on the current linearization.

Its proof, contained in Appendix C.1.2, is a modification of Theorem 5.5 in Acemoglu [2009]. It features the infinite horizon budget constraint, from which some additional economic intuition is garnered. The result intrinsically concerns linear approximations, trade-offs will arise through price dispersion in the non-linear setting.

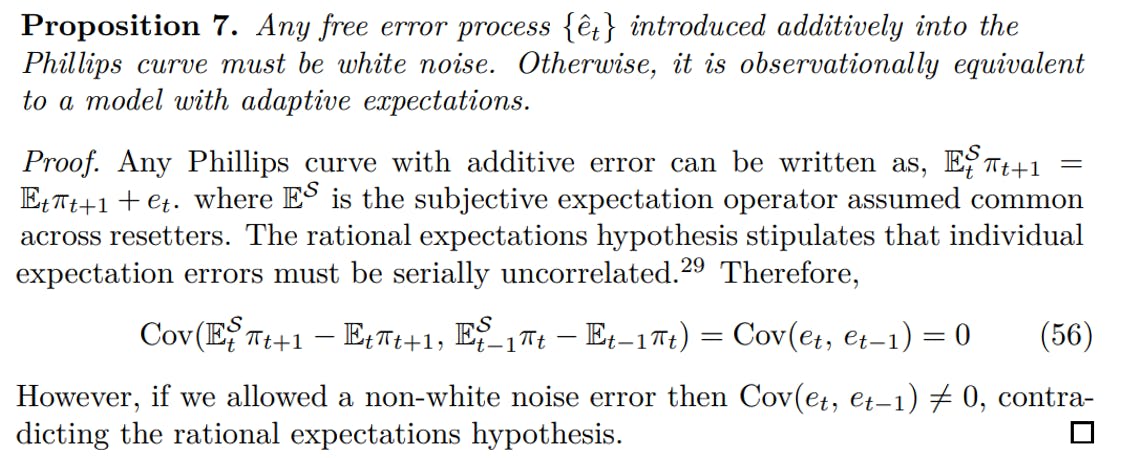

Subsequent results set out related problems with policy and persistence that will extend to alternative models with similar properties to the bifurcated Calvo model. Turning to the Phillips curve, to derive econometric interpretations it is necessary to add non-structural errors. The preferred interpretation is that this represents an expectation error. Future work should explore the distinct role and implications of structured and unstructured features of error terms.

Unexplained serial correlation in econometrics is an indication of misspecification, as discussed in Kennedy [2003]. This principle has underpinned empirical investigations of the Phillips curve, such as Galı and Gertler [1999] and others discussed in Mavroeidis et al. [2014].[30] The lack of viable persistence sources can have stark implications.

The system is not statistically identified for lack of valid instruments. Intuitively, when there is no persistence there is no way of instrumenting for future expectations, in particular for inflation. It should not be surprising that attempts to do so have been an empirical failure. This result implies that these estimates are in a strict sense ill-defined with respect to the underlying theory. The current model of the Phillips curve is not fit for policy purposes, where theory consistent econometric investigation is paramount.

Remark 5. Determinacy would become existence conditions if one were to interpret the bifurcated model as an approximation of a non-linear model based on its singular surface.

The final two results here concern policymaking. The first originated with Woodford [2001].

This familiar result states that monetary policymakers must "lean against the wind" sufficiently or they would lose control of inflation expectations. It is a figment of an entirely forward-looking model. The final result extends the Divine Coincidence idea to a stochastic environment. Its proof, similar to Proposition 8 is omitted.

If there is no (ad hoc) backward-looking component to the objective function and the Central Bank is interested in stabilizing the economy, it never changes the interest rate, in response to business cycle conditions. This justifies my decision to neglect backward-looking terms in the policy function. It should only respond to financial market conditions and long-run equilibrium movements. These were arguably features present in the Classical Gold Standard, as argued in Bayoumi et al. [1997]. Indeed, they could work automatically through financial market equilibrium forces.

This "do nothing" policy has a long tradition in classical and monetarist economics, (consult Friedman [1960], De Long [2000] and Chari et al. [2009]). However, it is not Keynesian and does not reflect modern policy setting anywhere with an inflation targeting framework. The persistence I derive will give a rationale for active monetary policy. The nature of optimal policy will be left for future work.

5.2.2 Non-Linear Approximations

It is become more feasible and increasingly common for economists to use nonlinear techniques, such as higher order approximations in their work. It is important to know that my conclusions are not a figment of the linearization. The first result shows that all but the most extreme of the previous results applies to a refined version of the non-linear model. Firm-specific labor supply is a popular simplifying assumption that allows us to divorce price dispersion from the optimizing decisions of the firm. It is isomorphic to setting ∆ = 1. It would show up elsewhere in the optimizing problem but we will ignore this as Divine Coincidence is a linear phenomenon.[31]

Proof. The proof consists of simply expanding out the non-linear Phillips curve without loss of generality. I can work with analytic functions (since they are dense in a standard function space)[32] Proceed once more by subtracting (41) from (42). Focus first on the bank of terms in ψt and MCt and use the labor supply curve formed from (19) and (38). However, it is no longer stochastically singular.

The central points are that σ = 1 rules out output terms not entering through marginal costs, whilst cross-product terms remove stochastic singularity. The second bank of terms is

Author:

(1) David Staines.

[29] This formulation is a weak form of the rational expectations hypothesis, as opposed to the strict form where the individuals fully understand the structural model which here would take us back to stochastic singularity.

[30] Similar sentiments and goals appear in Rotemberg and Woodford [1996] and Nakamura and Steinsson [2010] among others.

[31] Alternatively we could imagine an ad hoc demand system which will be shown in the next subsection.

[33] These high order approximations are not the focus here but in application terms in ψ and A would be normalized. Technology shocks can enter first order dynamics if there is uncertainty or disagreement about the output gap measure. However, this persistence does not carry over to inflation response to a demand shock (see C.2.2).

如有侵权请联系:admin#unsafe.sh