2024-2-14 02:1:51 Author: securityboulevard.com(查看原文) 阅读量:7 收藏

Proactive Fraud Prevention Strategies and Frameworks

To win the battle against fraud, first you have to detect it. Then you have to prevent it. By proactively identifying and stopping potential threats, you significantly reduce the severe reputational, legal, and financial risks of fraud. Let’s explore some proactive prevention strategies and how they can be implemented into robust fraud prevention frameworks.

Data Analysis for Fraud Prevention

Data is your most potent weapon against fraud. By rigorously analyzing transaction data, user behavior, and historical trends, you can identify potential vulnerabilities in your defenses—and shore them up before they’re exploited.

For example, Seattle Coffee’s e-commerce store was regularly hit by carding attacks. Their mitigation efforts were manual and time-consuming. During their trial of the DataDome solution, our credit card fraud monitoring immediately detected malicious bots that the previous solution had missed. Today, Seattle Coffee’s online store no longer suffers from frustrating slowdowns and excessive transaction costs.

Predictive Modeling to Forecast Fraud

Predictive modeling uses historical data to forecast potentially fraudulent activities. It can predict the likelihood of a transaction being fraudulent based on multiple variables like transaction amount, location, time, and previous behavior.

For example, KISS USA struggled with payment failures. They had no way to understand whether the failures were because of carding bots or just declined cards. Because of DataDome’s predictive modeling, malicious bots browsing the KISS USA website are now identified and blocked while genuine users are let through.

Risk Scoring to Evaluate Transaction Trustworthiness

Risk scoring is a method where each transaction is assigned a score based on its perceived threat level. Factors influencing this score include user behavior, transaction details, device information, and more. A high-risk score means a transaction is more likely to be fraudulent.

You can implement risk scoring by setting up algorithms that factor in various variables to assign a risk score. Over time, with continuous feedback, this scoring system can be refined for higher accuracy. Payment fraud protection software generally uses some kind of risk scoring to identify threats.

Benefits of Advanced Fraud Monitoring Software

Advanced fraud monitoring software is an investment into the future of your business. It presents you with benefits that extend beyond threat prevention. Here are some of the most prominent benefits:

High Accuracy in Detecting Sophisticated Fraud Patterns

Modern fraudsters use intricate and evolving techniques to defraud your business. Advanced fraud monitoring software is the best way to keep up, because such software continuously learns and adapts. Even the most covert fraudulent activities won’t slip through the cracks.

Fewer False Positives and Negatives

False alarms aren’t good for your business. They consume resources, alienate genuine customers, and divert attention from actual threats. Advanced software, by virtue of their algorithms, drastically reduces such false alarms. Transaction fraud detection means that genuine transactions are processed smoothly, while genuine threats are noticed and stopped.

Cost Savings and Improved Operational Efficiency

Efficient fraud monitoring software directly impacts the bottom line. By proactively detecting and preventing fraud, you can avoid financial, reputational, and legal damage. It also means fewer manual interventions and more time to spend on productive activities.

Leveraging Real-Time Monitoring for Fraud Prevention

Uninterrupted real-time monitoring is crucial for preventing fraud, because an unmonitored period of even a few minutes can be the difference between successful fraud prevention and significant loss.

Technologies and tools that enable real-time fraud monitoring include cloud-based systems that can run on any device, advanced analytics platforms that allow businesses to process massive streams of data in real-time, and integrated APIs that connect different platforms and tools so there are seamless data flows and instant alert mechanisms.

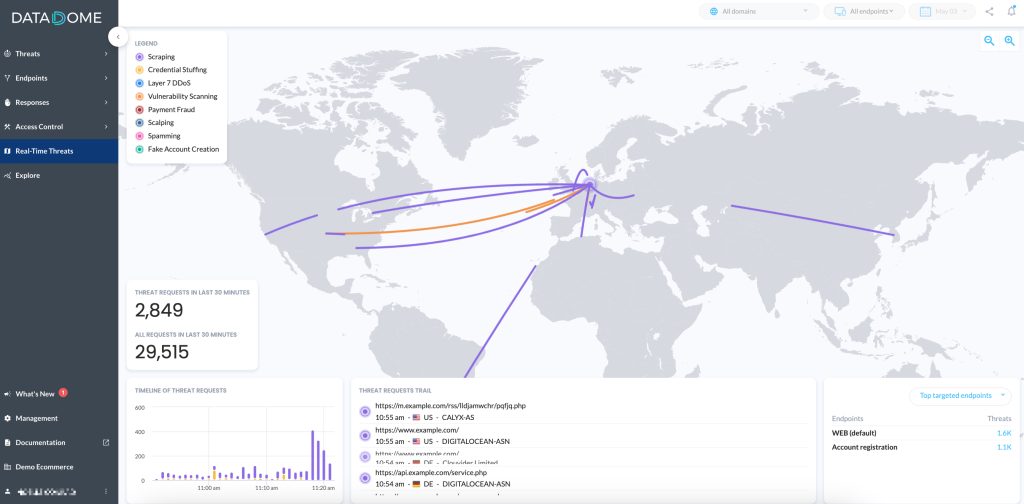

A view of the DataDome Real-Time Threat dashboard.

For example, when the French online insurance and service comparison platform Lesfurets implemented DataDome, they immediately noticed attacks on many different endpoints. DataDome blocked these attacks, improving the KPIs of Lesfurets as well as the reputation with their partners.

As another example, a major travel booking platform struggled with bots that were bypassing their CAPTCHAs. They decided to try out DataDome, which analyzed every single request to their websites, mobile apps, and APIs in real-time to block all malicious bots that were previously bypassing their defense setup.

Harnessing Automation & AI for Transaction Fraud Monitoring

Automation and artificial intelligence (AI) are revolutionizing fraud monitoring. Automation minimizes manual intervention and reduces the risk of human errors, while AI in fraud detection software improves its efficiency, accuracy, and overall effectiveness.

Examples of AI-driven technologies include neural networks designed to recognize patterns and make decisions based on vast amounts of data, natural language processing (NLP) to detect fraud in textual data like emails or user feedback, and deep learning to sift through multi-layered data sets and unearth intricate fraud patterns.

Advanced fraud protection software that combines real-time monitoring with automation and AI gives businesses a fighting chance against all kinds of fraud and automated threats without having to spend significant resources.

Top Features of a Fraud Monitoring Solution

When you’re in the market for a robust fraud monitoring solution, you need to look for something that can fully protect you while also being efficient and adaptable. This means you need to look for the following features:

- Real-Time Fraud Detection: Instantly flags suspicious activities, minimizing potential risks.

- AI-Powered Analysis: Adapts and learns from user patterns, offering nuanced detection capabilities.

- Granular Reporting: Offers detailed insights into fraud attempts and patterns to help with strategic decision-making.

- Behavior Analysis: Understands user behavior intricacies, differentiating between genuine users and bots or malicious entities.

- Multi-Layered Security: Offers various layers of protection, ensuring a holistic defense against multiple fraud types.

- Intuitive Dashboard: A user-friendly interface for at-a-glance insights and easy management.

- Seamless Integration: Easily integrates with other platforms and systems without disrupting existing workflows.

- Automated Alerts: Sends instant notifications when it detects any irregularities, while also taking immediate action.

Monitor Fraud in Real-Time with DataDome

DataDome is an advanced fraud protection solution that monitors and stops fraud in real-time. It identifies and tackles threats as they appear, blocking them within milliseconds. It does so by relying on AI and machine learning to always stay ahead of even the latest automated threats.

DataDome can protect all your endpoints, from your websites to your mobile apps to your APIs. It takes minutes to install, has many integrations so it easily fits within your existing digital architecture, and runs on autopilot. DataDome is a robust and multi-layered shield against automated threats and fraud. Try it out for yourself or book a live demo today.

如有侵权请联系:admin#unsafe.sh