Continuing the blog series on Universal Parallel Accounting, I will now explain what changes 2024-1-11 23:42:44 Author: blogs.sap.com(查看原文) 阅读量:22 收藏

Continuing the blog series on Universal Parallel Accounting, I will now explain what changes for corporate customers with the introduction of Profit Center Valuation alongside Group Valuation. This is of particular interest to large corporations who want to create a management view of their organization alongside the legal reporting view. If you are new to the topic of Universal Parallel Accounting, please refer to Sarah Roessler‘s excellent introduction to the topic: Universal Parallel Accounting in SAP S/4HANA. You may also want to refer to my blog introducing group valuation in the context of inventory accounting: Inventory Accounting with Universal Parallel Accounting in SAP S/4HANA 2022

What is the difference between legal, group and profit center valuation?

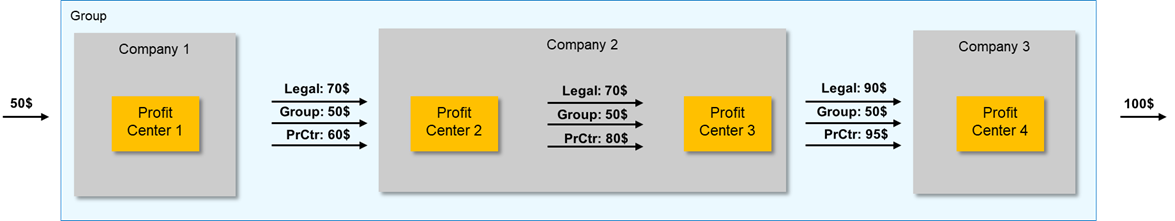

Let’s start by looking at the valuation requirements within a large corporate group. Figure 1 shows the valuation relevant entities within a corporation. The group as a whole is represented by the blue box (the controlling area) and the three grey boxes (Company 1, Company 2 and Company 3) represent company codes within the group. The three affiliated companies can trade with one another at arm’s length (legal valuation) and as part of the group (group valuation) with the same transactions represented from different viewpoints. The legal valuation includes an intercompany markup, whereas the group valuation views the same transaction as if the company barriers did not exist and the transaction can be recorded “at cost”. This transparency allows the organization to determine how best to transact for the good of the group as a whole rather than for the good of the individual selling companies.

The profit center valuation provides an additional management view where the profit centers can sit within the company code (so Profit Center 2 and Profit Center 3 represent plants within Company 2), at the same level as the company code (Profit Center 1 and Profit Center 4) or above the company code (typically the larger divisions with a group). Profit center valuation goes beyond Profit Center Accounting (which is simply the assignment of business transactions to profit centers for reporting purposes) to allow the definition of additional prices for the trade between profit centers whether these are intercompany or intracompany goods movements.

Figure 1: Corporate Group with Companies and Profit Centers

How does group and profit center valuation relate to Group Reporting?

As you think about the need for group and/or profit center valuation within your organization, it is important to align these needs with the requirements for Group Reporting. Typically the consolidation process is responsible for eliminating the impact of intercompany trade from the group financial statements and the classic approach takes the financial statements for the affiliated companies (the legal view) as its starting point, but it is also possible to use the group valuation view to provide an alternative view of the organization’s business for management purposes. If you use SAP’s Group Reporting solution you can define any of the ledgers used in Figure 1 as Group Reporting Preparation Ledgers so that additional information about the consolidation units, financial statement items, and so on is included in the journal entries for operational accounting, as shown in Figure 2.

Figure 2: Group Reporting Preparation Ledger

Ledger Settings for Universal Parallel Accounting

From the point of view of Universal Parallel Accounting, the multiple views illustrated in Figure 1 are represented by single valuation ledgers, each of which can potentially be used as the starting point for Group Reporting. Table 1 shows sample ledgers settings, where 0L and 2L are legal valuations, 4G is for group valuation and PC for profit center valuation.

If you are not yet using Universal Parallel Accounting, the old recommendation to use a multi-valuation ledger for group and profit center valuation continues to apply (for more details refer to this SAP Note Implementing Transfer Prices). With Universal Parallel Accounting the new ledgers for group and profit center valuation use the same accounting principle and fiscal year variant as ledger 0L (previously Asset Accounting did not support the use of the same accounting principle in multiple ledgers).

| Ledger | Valuation View | Germany | France | Switzerland | Austria |

| 0L (Headquarters) unconsolidated |

Legal Valuation | IFRS – common accounting principle, common calendar | |||

| 2L (Companies) unconsolidated | Legal Valuation | HGB | PCG | Swiss GAAP | UGB |

| 4G (Headquarters) consolidated |

Group Valuation | IFRS – with additional elimination postings | |||

| PC (Headquarters) management |

Profit Center Valuation | IFRS – with additional elimination postings | |||

Table 1: Sample Ledger Structure

Besides the move to single-valuation ledgers, one of the key changes with Universal Parallel Accounting is that the currency and valuation profile is no longer required. Instead the ledger settings determine which currencies are supported, meaning that you can now capture group values and profit center values in as many currencies as you need to manage your business. Figure 3 shows sample configuration for the profit center valuation ledger (IMG: Financial Accounting > Financial Accounting Global Settings > Ledgers > Ledger > Define Settings for Ledger and Currency Types). The nomenclature for the currency types is carried over from SAP ERP, so currency types beginning with 1 represent local currency and currency types beginning with 3 represent group currency, and the additional 1 represents group valuation and 2 profit center valuation. In this example we’ve extended the ledger settings for the local (1) and group currencies (3) to include a hard currency (4) in profit center valuation (2) and a freely defined currency (ZA).

Figure 3: Currency Settings for Profit Center Valuation Ledger

Elimination Postings for Intercompany Movements in the Profit Center View

While organizations have been using group valuation in its classic form for many years, what changes with Universal Parallel Accounting is the ability to create elimination postings to a group valuation clearing account to remove the impact of intercompany goods movements from the group view in the delivering company. Figure 4 shows an intercompany scenario, where the revenues from the intercompany invoice and the cost of goods sold from the intercompany delivery are posted in all ledgers.

- In the legal ledgers, the intercompany revenue and cost of goods sold are considered arm’s length trading and recognized in the delivering company.

- In the group valuation ledger and in the profit center valuation ledger elimination postings are made that remove the intercompany revenues and cost of goods sold to a valuation clearing account in the delivering company.

A full description of the new options for intercompany sales and stock transfers is beyond the scope of this article. To find out more about the new approach, please refer to Gerhard Welker‘s blog: Advanced Intercompany Sales and Stock Transfer.

Figure 4: Advanced Intercompany Sales Process, Showing Elimination Postings in Delivering Company

With the intercompany invoice (document A) intercompany revenue is posted in full and then eliminated in the delivering company in the group and profit center valuation ledgers. The elimination postings can be identified by the transaction type TCV (transactional consolidation), as shown in Figure 5. You can define the group valuation clearing account using transaction 8KEN or IMG: Controlling > Manage Multiple Valuation Approaches/Transfer Prices > Level of Detail > Define Valuation Clearing Account.

Figure 5: Elimination Postings for Intercompany Revenue

Management Markups for Intracompany Movements in Profit Center View

From a legal point of view, plant-to-plant stock transfers that take place within the same company code are handled at cost, with no additional markup, but profit center valuation can be used to create a management view of these transactions by posting an internal revenue and internal cost of goods sold as though the two plants belonged to different legal entities. Figure 6 shows a sample posting for an intracompany goods movement with additional lines for revenue and cost of goods sold. The accounts to be used for the internal goods movements are defined using transaction 0KEK or IMG: Controlling > Profit center Accounting > Transfer Prices > Settings for Internal Goods Movements > Define Account Determination for Intercompany Goods Movements. These are the accounts beginning with 8* in Figure 6.

Figure 6: Intracompany Markups in Profit Center View

Price Definition for Profit Center Valuation

The pricing procedure for profit center valuation is based on the pricing procedures TP0001 and TP0002 shown in Figure 7. These determine the base price (set in the material master), and the price or percentage markup to be applied when the goods movement results in a change of profit center.

Figure 7: Pricing Conditions for Profit Center Valuation

Price condition TPB1 references the material price in the Accounting View of the Material Master Transaction MM03). By scrolling through the entries in the Currency Type field, you can view all the combinations of currency and valuation views defined in the ledger (Figure 3) until you find those relevant for profit center valuation. Here we are looking at the value in group currency (3) and profit center valuation (2).

Figure 8: Material Prices for Profit Center Valuation

Cost Estimates in Profit Center Valuation

The value to be used for the purposes of profit center valuation can be set using a standard cost estimate (transaction CK11N) as shown in Figure 9. SAP delivers costing variants for group and profit center valuation, with a costing type that links to the relevant ledger (4G or PC) and a valuation variant that links to the valuation view for profit center valuation in order to select the relevant prices for the raw materials and activity rates.

Figure 9: Material Cost Estimate for Profit Center Valuation

The results of the material cost estimate are released for use in inventory valuation using transaction CK24 (Mark/Release Standard Prices). Figure 10 shows the two cost estimates for legal valuation in ledgers 0L and 2L, plus additional cost estimates for group valuation in ledger 4G and profit center valuation in ledger PC.

Figure 10: Releasing Cost Estimates for Multiple Ledgers

Implementing Profit Center Valuation

The settings for group and profit center valuation, including the costing variants shown above, are delivered as best practices and both can currently only be implemented in greenfield environments. Scope Item 5W2 contains the settings for group valuation and Scope Item 6VQ contains the settings for profit center valuation. You can also make the configuration settings manually using the IMG. Since you cannot currently add a new ledger for group or profit center valuation, there is not yet a migration scenario to add these valuations in a running system.

Further Resources

Universal Parallel Accounting is activated using a business function. For more details on the business function in general, please refer to the documentation: Business Function: Universal Parallel Accounting

The first migration tools for legal valuations are activated using an additional business function. For more details, please refer to the documentation: Business Function: Universal Parallel Accounting Migration.

Profit Center Accounting in Universal Parallel Accounting is based on the universal journal. For more details about the conversion from EC-PCA, please refer to SAP Note 2425255: Profit Center Accounting in the Universal Journal

For a full list of restrictions, please refer to SAP Note 3191636: Universal Parallel Accounting – Scope Information

For the restrictions with regard to advanced intercompany please refer to SAP Note 3366067: Restrictions for Advanced Intercompany Sales in OP2023.

For the restrictions in SAP S/4HANA 2022, please refer to SAP Note SAP Note 3419623: Restrictions for Profit Center Valuation in Combination with Advanced Intercompany Sales

如有侵权请联系:admin#unsafe.sh