This blog post will delve into the intricacies of the Down Payment Process with S4 HANA Finan 2024-1-5 03:15:9 Author: blogs.sap.com(查看原文) 阅读量:23 收藏

This blog post will delve into the intricacies of the Down Payment Process with S4 HANA Finance. Down Payments or Advance payments, constitute a financial practice where parties pay in advance before the actual exchange of goods and services takes place. In the context of S4 HANA Finance, down payments are treated separately on the balance sheet, distinct from the conventional Accounts Payables or Accounts Receivables balances. All these down payments need to be clear once the goods and services are completed either manually or by automatic payment program. Shedding light on its significance and the steps involved in handling down payments.

- Configuration for Down payment in SAP (Tcode: FBKP)

- Initiate Down payment Request

- Post Supplier Down Payment

- Create Down Payment Invoice

- Create Incoming Invoice (Without P.O)

- Create Incoming Invoice (With P.O)

- Invoice creation thru upload template

- Clear Supplier Down Payment

- Schedule Automatic Payments

- Post Outgoing Payments (Manual)

- Accounts Payable Overview

- Aging Analysis

Configuration for Down payment in SAP (Tcode: FBKP)

Maintain Accounting configuration to create special GL accounts for Vendors and Customers

Figure: 1 – Configuration Screen FBKP

Double click Special G/L

Creation of Down Payment Request G/L Accounts for Vendors / Suppliers

Figure: 2 – Create Down Payment Request G/L Account for Vendors / Suppliers

Double click the above highlighted and assign Reconciliation Account and Special GL Account

21100000 is Vendor Reconciliation account, 12119000 is Special GL Account Vendor / Supplier Down Payment request GL Account indicated by “F

Figure: 3 – Assign G/L Accounts to Vendor account type

| Spl GL | Description | Recon A/C | GL Description | Alt Recon ac | GL Description |

| F | Down payment Request | 21100000 | Payables Domestic | 12119000 | Supplier Down Payment Requests |

Creation of Down Payment Request G/L Accounts for Customers

Figure: 4 – Create Down Payment Request G/L Account for Customer

Double click the above highlighted and assign Reconciliation Account and Special GL Account

GL Account 21190000 is Customer Reconciliation Account, 12100000 is Special GL Account Customer Down Payment request GL Account indicated by “F

Figure: 5 – Assign G/L Accounts to Customer account type

| Spl GL | Description | Recon A/C | GL Des | Alt Recon ac | GL Des |

| F | Customer Down payment | 12100000 | Receivable Domestic | 21191000 | Customer Down Payment Requests |

Creation of Down Payment G/L Accounts for Vendors / Suppliers

Figure: 6 – Create Down Payment G/L Account for Vendors / Suppliers

Double click the above highlighted and assign Reconciliation Account and Special GL Account

21100000 is Vendor Reconciliation account, 12110000 is Special GL Account Vendor / Supplier Down Payment GL Account indicated by “A

| Special GL | Description | Recon A/C | GL Des | Alt Recon ac | GL Des |

| A | Supplier Down payment | 21100000 | Payables Domestic | 12110000 | Supplier Down Payments |

Creation of Down Payment G/L Accounts for Customers

Figure: 8 – Create Down Payment G/L Account for Customers

Double click the above highlighted and assign Reconciliation Account and Special GL Account

12100000 is Customer Reconciliation account, 21190000 is Special GL Account Customer Down Payment GL Account indicated by “A

Figure: 9 – Assign G/L Accounts to Vendor account type

| Spl GL | Description | Recon A/C | GL Des | Alt Recon ac | GL Des |

| A | Customer Down payment | 12100000 | Receivables Domestic | 21190000 | Customer Down Payments |

Initiate Down payment Request (Fiori App)

This is an optional step to create note in system for down payment. No accounting document is created. Down payment can be made based on this request

Figure: 10 – Down Payment Request

Showed as ‘Noted Items’ in Vendor line-item display. In contrast, the document contains no offsetting entries to other documents.

On the initial screen, you determine which line items should be displayed. For special G/L transactions, you select special G/L transactions.

If you want to display down payment requests only, you can use the selection function using the special G/L code “F”. Down payment requests are displayed in a separate column

Figure: 11 – Showed as Noted Items in Vendor line item display

Down Payment Process Flow

Figure: 12 – Down Payment Process Flow

Post Supplier Down Payment (Fiori App)

Down payment can be made with or without down payment request. System post to alternate GL account to display separately in the Balance sheet

Figure: 13 – Post Supplier Down Payment

Figure: 14 – Display Document

Vendor line-item display with Special GL Indicator & alternate reconciliation account

Accounting entries are as below

| Posting key | GL Accounts | Account Number | Amount | Currency | |||

| Dr | 29A | Special GL | Vendor AC | Supplier Down Payment | 12110000 | $ 2,000.00 | USD |

| Cr | 50 | Bank Outgoing A/C | 10010000 | $ 2,000.00 | USD |

Create Down Payment Invoice (Fiori App)

Create Incoming Invoice (Without P.O)

Use this Fiori app to create a down payment Invoice without P.O. As soon as you enter the Vendor details, Invoice details will get an information message that Down payment exists for this vendor

Figure: 15 – Create Incoming Invoice

The system generates an accounting document for the down payment invoice

Figure: 17 – Document Ledger View

Accounting entries are as below

| Posting key | GL Accounts | Account Number | Amount | Currency | |||

| Dr | 40 | Expense | 65003000 | $ 12,000.00 | USD | ||

| Cr | 31 | Vendor A/C | Regular Payables Reconciliation Acct | 21100000 | $ 12,000.00 | USD |

Import Supplier Invoices

AP Invoices thru upload template

Figure: 18 – Import Supplier Invoices

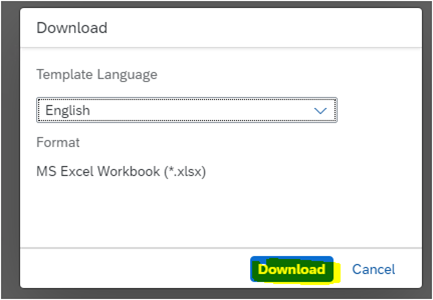

Click Download for Template

Figure: 19 – Download Template

After downloading the template, enter all details on the template upload the file in the system.

Figure: 20 – Upload the template

Highlight the worklist item and select “Check” to see in simulation mode

Figure: 21 – Simulation results

If you are satisfied with the simulation results, click Post

Figure: 22 – Posted an Invoice

Invoice is posted successfully

Figure: 23 – Supplier Invoice

Create Incoming Invoice (With P.O)

First create a P.O with “Manage Purchase Orders”

Figure: 24 – Manage Purchase Orders

Goods receipt with ” Post Goods Movement app

Figure: 25 – Post Goods Movement

Create Supplier Invoice with reference to P.O

Figure: 26 – Create Supplier Invoice

Figure: 27 – Create Supplier Invoice with reference to PO

Invoice posted successfully

Figure: 28 – Invoice Posted

Clear Supplier Down Payment

Once the goods and services are delivered or completed, down payments need to be cleared. Special G/L should be cleared. Down payment clearing moves the balance from alternate reconciliation account to payables reconciliation account. This can be done manually or through automatic payment program, ensuring accurate financial reconciliation. The system generates an accounting document for the clearing. From the above scenario, we received the down payment of $2000 and an expenses of $12,000

Figure: 29 – Clear Supplier Down Payment

Figure: 30 – Down Payment Clearing

Down Payment Clearing completed with accounting document

Figure: 31 – Clearing Document

Accounting entries are as below

| Posting key | GL Accounts | Account Number | Amount | Currency | |||

| Dr | 26 | Vendor A/C | Regular Payables Reconciliation Acct | 21100000 | $ 2,000.00 | USD | |

| Cr | 29A | Special GL | Vendor AC | Supplier Down Payment | 12110000 | $ 2,000.00 | USD |

Manage Automatic Payments / Schedule Automatic Payments

With this app you can schedule payment proposals or schedule payments directly and get an overview of the proposal or payment status. The app identifies the overdue invoices and checks whether all the required payment information is complete. Run automatic payment program to clear the open items against the Vendor after clearing down payments. Either you can select the invoice document number in free selection screen or without

Figure: 32 – Schedule Automatic Payments

Execute the payment run and see the postings

Figure: 33 – Payment Processed

The final accounting entries are as below

| Posting key | GL Accounts | Account Number | Amount | Currency | |||

| Dr | 25 | Vendor AC | Regular Payables Reconciliation Acct | 21100000 | $ 10,000.00 | USD | |

| Cr | 50 | Bank Outgoing A/C | 10010000 | $ 10,000.00 | USD |

Post Outgoing Payments (Manual)

With this app you can post and clear a single outgoing payment in one step. You usually perform outgoing payments automatically based on payment proposals. However, if you want to perform a payment immediately, you need to enter the payment data manually. You can clear outgoing payments with open items. You can also post an outgoing payment on account or to a G/L account.

Figure: 34 – Post Outgoing Payments

Enter all payment details and click process open items, select only the line item you want clear the payment and post it

Figure: 35 – Process Open Items

Figure: 36 – Select the Open Item

Accounts Payable Overview

With this analytical overview app, you can monitor important accounts payable indicators and access the relevant accounts payable apps. You can use the filters to limit the data behind the indicators to the information most relevant for you. You can track down the Parked, Blocked, Posted invoices and Payable Outstanding’s, Payments etc.

Figure: 37 – Accounts Payable Overview

Aging Analysis

With this app you can see the aging information across your organization so that you can identify negative trends in the total payable amount, the net due amount, and the overdue amount. This allows you to timely react by having your team taking appropriate actions to reverse these trends.

Figure: 38 – Aging Analysis Report

Conclusion

This blog post provides some insights on the down Payment process in S4 HANA Finance is a curial aspect of financial transactions, offering flexibility and transparency in handling advance payments. By segregating down payments on the balance sheet, organizations can maintain a clear and accurate financial records. Understanding and effectively managing the down payment process is essential for managing integrity and ensuring smooth business operations. Share your feedback in the comment section

如有侵权请联系:admin#unsafe.sh