2024-1-4 03:37:57 Author: securityboulevard.com(查看原文) 阅读量:4 收藏

Fraud is everywhere, and it’s affecting you whether you realize it or not. From fraudulent credit card charges to identity theft, fraud can cause serious financial and emotional damage. That’s why fraud detection, management, and analysis are crucial to protecting yourself and your business.

Data collected by the Federal Trade Commission revealed that in 2021, reported fraud losses increased by over 70% and cost consumers over $5.8 billion. Consumer losses due to fraud totaled close to $8.8 billion in 2022. Fraud losses in California alone led to an estimated cost of $1349 million in 2022. With these numbers in mind, it’s clear why it’s essential to stay vigilant about the latest fraud prevention strategies.

Since awareness is the best prevention method, in this post, we’ll dive into what fraud detection, management, and analysis are, how they work, and why they matter for businesses like yours. We’ll explore the types of fraud businesses face and the strategies they can use to combat them and help safeguard your business.

Jump to:

- What are the different types of fraud?

- How is fraud detected?

- What are Credit Card Fraud Prevention Solutions?

- What is Fraud Analytics?

- What are Fraud Management Tools?

- Preventing Fraud Through Cybersecurity Awareness

What are the different types of fraud?

Fraudulent activities have become a significant threat to businesses across all industries, and enterprises need to employ fraud detection processes before they are adversely affected. Fraud detection refers to a structured approach to recognizing, tracking, and preventing fraud, which can be manual or automated.

To mitigate risks, businesses can use risk management strategies, including fraud detection software, company policies, and staff ranging from risk managers and trust officers to fraud analysts.

Fraud comes in a wide range of forms. Here are the most common:

- Credit Card Information Theft – This fraud occurs when someone steals credit card information to purchase goods or services charged to the card’s original owner.

- Account Hijacking – Account hijacking is credential theft ranging from identity documentation to financial information, used to steal money or sensitive information.

- Fake Account Creation – Fraudsters create fake accounts for finance or personal identification applications for personal gain.

- Reward/Loyalty Abuse – This fraud involves misusing accounts that offer rewards or loyalty points, ranging from signup promotions to purchase points and other related rewards.

- Friendly Fraud – Friendly fraud occurs when the actual credit card holder raises a payment dispute because they forgot that they made the purchase in the first place or had unanticipated issues.

- Affiliate Fraud – Affiliates in a marketing arrangement purposefully sending bad traffic to the target site is known as affiliate fraud or traffic fraud. The online gambling and gaming industry is especially vulnerable to this fraud, with attackers using the PPC (pay-per-click) model to monetize artificial traffic.

- Return Fraud – This fraud is also known as online purchase return fraud. Fraudsters buy items in an e-commerce store with the sole intent of misusing the store return policy for personal gain. They might do this to obtain free goods or services in exchange for little or no money.

How is fraud detected?

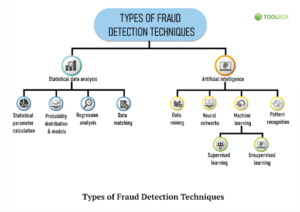

There is a wide range of fraud detection tools, most of which rely on some form of data analysis. These include:

- Statistical Parameter Calculation, which evaluates metrics like probability distributions, performance metrics, and averages for fraud-related data gathered during data extraction

- Probability Distributions and Models, where different fraudulent activities are mapped to probability distributions and models using different parameters

- Data Matching, where different data sets are compared using programmed algorithms or loops

- Regression Analysis, which analyzes the relationship between two or more variables to understand and define relationships between various fraud-related variables (this helps in forecasting future fraudulent actions based on usage patterns of fraud variables in possible fraudulent activities)

- AI-Based Approaches are especially efficient at fraud detection and include methods such as:

- Data Mining enables classification and data segmentation to find correlations between data sets for fraud detection and prevention, especially in transaction fraud detection.

- Neural Networks, which predict fraud-related data that can be mapped against financial documents and audits

- Machine Learning (ML), which identifies previous fraud patterns and predicts future fraudulent activities and transactions

- Real-Time Fraud Detection relies on machine learning and AI-based algorithms that can analyze large amounts of data quickly and accurately to identify fraudulent activities in real-time.

- Advanced Fraud Detection Systems go beyond historical data and have complex features that can be customized according to enterprise requirements.

- Internal Fraud Prevention Systems can be established within a company using the right technical know-how and IT resources. This requires employees from risk management backgrounds with expertise in transactions.

What are Credit Card Fraud Prevention Solutions?

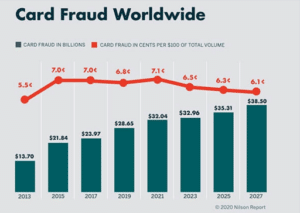

The growing problem of credit card fraud affects millions of individuals and businesses worldwide. It is a financial crime involving stealing sensitive information such as credit card details, personal identification numbers (PINs), and passwords. Fraud can be committed in various ways, including skimming, phishing, and hacking.

To combat this problem, credit card companies and financial institutions have developed different solutions to prevent these incidents. These solutions use advanced technologies such as machine learning, artificial intelligence, and big data analytics to identify real-time fraudulent transactions.

The Benefits of Credit Card Fraud Prevention Solutions

The right credit card fraud prevention solution helps your organization with many benefits, including:

- Identify and block fraudulent transactions before completion, minimizing the financial impact on customers.

- Enhance the reputation of financial institutions by demonstrating their commitment to protecting their customers’ financial well-being.

- Build customer trust and loyalty, which leads to increased customer satisfaction and retention.

- Reduce operational costs associated with fraud investigations, chargebacks, and customer support.

- Improve regulatory compliance related to fraud prevention.

- Enhance data security and prevent unauthorized access.

- Monitor transactions in real-time to detect and respond to fraudulent activities promptly.

- Gain a competitive advantage by implementing robust fraud prevention measures.

- Contribute to improved business performance and profitability by reducing financial losses and improving customer satisfaction.

Key Features of Credit Card Fraud Prevention Solutions

Below, we’ve listed the essential features you should look out for when selecting a credit card fraud prevention solution:

- Real-time transaction monitoring – Financial institutions can detect suspicious transactions as they happen, allowing them to block fraudulent transactions in real time and minimize financial losses.

- Machine learning (ML) and artificial intelligence (AI) – Credit card fraud prevention solutions can use ML and AI to learn and adapt to new fraud patterns, ensuring their effectiveness against sophisticated fraud methods.

- Data analytics – By analyzing large volumes of transaction data, financial institutions identify patterns and trends that may indicate fraudulent activities, enabling proactive detection and prevention of fraud.

- Multi-factor authentication – Some credit card fraud prevention solutions incorporate additional verification steps beyond a simple username and password, making it more difficult for fraudsters to access sensitive financial information.

- Geo-location tracking – Geo-location tracking can be used to verify the location of the card user and identify any suspicious activities or transactions occurring outside of typical user locations.

- Card blocking and replacement – Block a compromised card and issue a replacement card immediately, minimizing the financial impact on the cardholder and reducing the risk of further fraudulent activities.

Learn more at: Top 10 Credit Card Fraud Detection Solutions in 2023

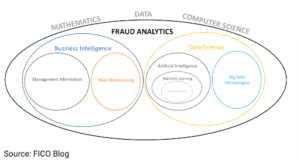

What is Fraud Analytics?

As digital transactions have become more prevalent, they have created many new opportunities for cybercriminals to steal and manipulate personal data. In 2023, the cost of cybercrime is expected to hit $8 trillion annually. To combat this threat, businesses and consumers must be constantly vigilant.

Fraud analytics plays a critical role in helping businesses protect their data, minimize financial losses, and maintain the confidence and trust of their customers.

What Is Fraud Analytics, and Why Is It Important?

Fraud analytics uses big data to gain insights into the online fraud attacks that target a business. It involves having a threat intelligence team analyze relevant data to identify where attacks are coming from, how they are getting through defenses, and what can be done to prevent them more effectively.

Cybercriminals and fraudsters target organizations of every size and industry, with businesses in finance, manufacturing, healthcare, and pharmaceuticals particularly vulnerable. Online fraud can result from many types of cyberattacks, including social engineering and phishing attacks, account takeover attacks, SIM swapping attacks, ransomware attacks, malware programs, and man-in-the-middle attacks. The most effective and pernicious cyberattacks take place without the target’s awareness.

Fraud analytics can help detect and prevent attacks proactively instead of reacting to them afterward. By taking data sets from various sources and channels, fraud analytics provides a broad overview of every possible attack vector. It uses advanced statistical analysis techniques and state-of-the-art AI and machine learning technology to identify the subtle patterns of behavior associated with fraud. This creates predictive models that give businesses the best chance of catching and stopping attacks before they cause significant harm.

How Using Analytics Prevents Fraud

Customers and end users access online sites through various devices and locations, and cybersecurity protocols must align with how people engage with digital services. Passwords are easily compromised and need to be more robust to secure an account fully, but challenging users with increasingly rigorous authentication methods can be off-putting and cause undesirable friction.

Fraud analytics help fight cybercrime by allowing businesses to take proactive action and prevent attacks. By using the power of big data to assess risk and model threats, transactions and login attempts from bad actors can be rejected without disrupting the user experience.

Where Fraud Analytics Meets Cybersecurity

Despite the clear relationship between fraud prevention and cybersecurity, many organizations maintain separate units for these functions. Cybersecurity focuses on systemic, technological solutions designed to secure networks and devices against intrusion. Fraud prevention deals with the misuse of data that has already been compromised and often encounters attacks that bypass technological defenses by relying on deception and manipulation.

By integrating these two functions and allowing them to share data, cybersecurity, and fraud prevention teams can benefit from each other’s perspectives and develop more robust defenses. Joint training sessions help bridge the knowledge gap and facilitate more effective collaboration.

7 Ways to Use Fraud Analytics for Better Cybersecurity

The rise of digital transactions has created new opportunities for cybercriminals to steal personal data, leading to the need for better cybersecurity measures. Fraud analytics uses big data to gain insights into online fraud and can help businesses protect their data, minimize financial losses, and maintain customer trust.

By integrating fraud prevention with cybersecurity, businesses can benefit from both perspectives and develop more robust defenses.

There are a few ways you can use fraud analytics to improve cybersecurity:

- Use machine learning to improve fraud prevention algorithms

- Apply a “fraud score” to events and transactions

- Blacklist suspicious accounts and traffic sources

- Monitor user accounts for anomalies

- Monitor network traffic for signs of cyberattacks

- Conduct regular security audits

- Foster cross-functional collaboration between fraud prevention and cybersecurity teams.

Learn more at: 7 Ways to Use Fraud Analytics for Better Cybersecurity

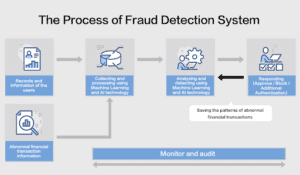

What are Fraud Management Tools?

As technology continues to evolve, so do fraudsters’ methods to carry out their illicit activities. Fraudsters use various tactics to carry out fraud, including identity theft, account takeover, and fraudulent purchases. The rise in fraudulent activities has increased the demand for fraud management tools.

Fraud management tools are software solutions designed to detect, prevent, and mitigate fraud in real-time. These tools use advanced algorithms to analyze data and detect anomalies, alerting organizations to potentially fraudulent activities.

Types of Fraud Management Tools

There are various types of fraud management tools that organizations can use to detect and prevent fraud:

- Transaction monitoring tools analyze real-time transactions to identify suspicious activities, such as unusual purchases or transactions.

- Identity verification tools are used to verify the identity of customers during onboarding or authentication processes. They use various methods such as biometrics, facial recognition, and document verification to confirm the user’s identity.

- Risk scoring tools analyze various factors, such as the user’s behavior, transaction history, and device used to access the account, to determine the likelihood of fraud.

- Data analytics tools use advanced analytics to detect patterns and anomalies in large datasets, allowing organizations to identify potential fraudsters.

- Advanced behavioral analytics tools use machine learning algorithms to analyze user behavior, such as mouse movements, typing patterns, and page navigation, to detect anomalies that may indicate fraud.

- Device fingerprinting tools analyze device-specific information, such as IP address, browser type, and device type, to create a unique “fingerprint” for each device. This can help detect fraudulent activities that originate from unfamiliar devices.

- Case management tools help organizations efficiently manage and investigate fraud cases by providing a centralized platform to monitor and track cases, collaborate with team members, and generate reports.

- AI-powered tools use artificial intelligence and machine learning algorithms to prevent and detect fraud in real-time by analyzing vast data to identify patterns and anomalies.

- Threat intelligence feed monitoring tools monitor and analyze threat intelligence feeds to detect potential fraud and cyber threats before they can cause damage to the organization.

- Security awareness training increases employees’ awareness of fraud and cyber threats and trains them to identify and report suspicious activities. It can also help to reduce the risk of human error or negligence leading to fraudulent activities.

Benefits of Fraud Management Tools

Using the right fraud management tools provides your organization with numerous benefits, including:

- Increased Security – Fraud management tools provide an additional layer of security, helping organizations to detect and prevent fraud in real-time.

- Cost Reduction – Fraud can be costly for organizations in financial losses and reputational damage. Fraud management tools can help reduce these losses and associated costs.

- Regulatory Compliance – Fraud management tools can help organizations comply with legal fraud prevention regulations and avoid non-compliance penalties.

- Improved Customer Experience – Implementing fraud management tools can help protect customers from fraud and increase their confidence in the organization, improving customer satisfaction and loyalty.

- Time-Saving – Fraud management tools automate many processes, such as fraud detection and investigation, saving organizations time and resources.

- Better Decision-Making – Fraud management tools provide organizations with real-time data and analytics, allowing for informed fraud prevention and detection decision-making.

- Fraud Prevention Culture – Implementing fraud management tools can help create a culture of fraud prevention within an organization, where all employees are aware of fraud risks and take proactive measures to prevent it.

- Integration with Other Systems – Fraud management tools can integrate with other systems, such as payment processing and customer management systems, to provide a comprehensive approach to fraud prevention.

Key Features of Fraud Management Tools

Fraud management tools have various features to help organizations detect and prevent fraud. Here are a few of the features you should look for:

- Real-time monitoring: Monitor transactions in real-time, allowing organizations to detect fraud as it happens.

- Automated alerts: Send alerts when suspicious activity is detected, enabling organizations to respond quickly and prevent further fraudulent activities.

- Customization: Customize your solution to meet your organization’s specific needs, including setting customized rules and thresholds for fraud detection.

- Data analysis: Use advanced analytics to detect patterns and anomalies in large datasets, enabling organizations to identify potential fraudsters.

- Multi-layered authentication: Only authorized individuals can access sensitive data and perform transactions.

- Case management: Use case management capabilities to document, investigate, and resolve suspected fraud cases efficiently.

- Integration: Integrate with other systems and applications, such as payment gateways and customer relationship management (CRM) tools, for a more comprehensive fraud prevention solution.

- User-friendly interface: Access an intuitive interface that makes it easy for non-technical users to understand and use the solution effectively.

- Ongoing support and updates: Get ongoing support and updates to ensure that the solution remains effective and up-to-date against the latest fraud techniques

Learn more at: Top 10 Fraud Management Tools

Preventing Fraud Through Cybersecurity Awareness

Fraud management tools are essential for organizations to protect themselves from the rise in digital fraud incidents. By implementing these tools, organizations can increase security, reduce costs, comply with regulations, and protect their reputation.

It is important to note that fraud management tools alone are not enough to combat fraud. Organizations must also invest in cybersecurity awareness and training to ensure that employees know potential threats and how to prevent them.

By creating a security-aware company culture and providing employees with cybersecurity awareness training, organizations can minimize the risk of fraud, protect their financial stability and reputation, and increase the chances that incidents of fraud will be recognized and mitigated before they cause serious harm to the organization’s operations.

CybeReady allows you to implement easy, engaging, and up-to-date cybersecurity training programs in your organization today. Schedule a demo now to find out how we can help you keep fraudsters at bay and ensure your organization’s security.

The post Comprehensive Guide to Fraud Detection, Management, & Analysis appeared first on CybeReady.

*** This is a Security Bloggers Network syndicated blog from Cyber Security Awareness Training Blog | CybeReady authored by Webzoly SEO. Read the original post at: https://cybeready.com/comprehensive-guide-to-fraud-detection-management-and-analysis

如有侵权请联系:admin#unsafe.sh