VALUATION OF A MATERIALS BASED ON LIFO/FIFO METHODSLast In First Out Valuation Last In Fi 2023-11-29 21:44:6 Author: blogs.sap.com(查看原文) 阅读量:13 收藏

VALUATION OF A MATERIALS BASED ON LIFO/FIFO METHODS

Last In First Out Valuation

Last In First Out Valuation (LIFO) valuation is based on the principle that the last deliveries of a material to be received are the first to be used. In this case, then no value change occurs for older material when new materials are received. Because of the LIFO method, the older material isn’t affected by the higher prices of the new deliveries of material. Thus, the older material isn’t valuated at the new material price, which prevents the false valuation of current inventory.

LIFO valuation enables the increased amount of material stock per fiscal year to be valuated separately from the rest of the material stock. This option is important so that new material is valuated at the correct amount, while old stock remains valuated without being affected by the new material price. A positive variance between the opening and closing material balances of a fiscal year is known as a layer for LIFO valuation. A layer can be valuated as a separate item. The total of a material is the sum of all layers.

A layer is dissolved if a negative difference exists between the opening and closing stock balances at the end of a fiscal year. This situation happens, for example, if all the new stock is consumed plus some of the existing stock. In the following section let’s discuss how to configure, prepare for, and run a LIFO valuation.

- Configuration

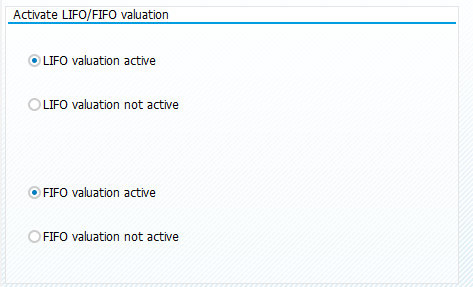

1.1 Activate LIFO/FIFO valuation.

it can be done by transaction code OMWE.

OR follow the navigation path.

SPRO –> IMG—> Materials Management –> Valuation and Account Assignment –> Balance sheet valuation procedures –> configure LIFO/FIFO METHODS —> General information —> Activate/deactivate LIFO/FIFO valuation.

Figure 1

1.2 Define LIFO/FIFO relevant movement types.

it can be done by transaction code OMW4.

OR follow the navigation path.

SPRO –> IMG—> Materials Management –> Valuation and Account Assignment –> Balance sheet valuation procedures –> configure LIFO/FIFO METHODS —> General information —> define LIFO/FIFO relevant movement types.

Figure 2

- Preparation

To instigate a LIFO valuation, several preparation steps must be completed. These steps include, ensuring that materials are defined for LIFO, setting up the base layers for valuation, and setting up the basis for comparison.

2.1 Flag material for LIFO

The flag is located within the material master on the accounting 2 tab, as shown in figure 3

Figure 3

2.2 Updating LIFO flag for a selection of materials

This can be done by using transaction code MRL6.

OR follow the navigation path.

SPRO –> IMG—> Materials Management –> Valuation and Account Assignment –> Balance sheet valuation procedures –> LIFO Valuation —> prepare —> select materials.

In the initial screen as shown in figure 4, enter selection parameters and select set radio button as well as the material master and LIFO index table checkbox and then click on execute.

Figure 4

2.3 Setting up the base layers for valuation.

The measurement of material value changes is based on comparing different layers. Before LIFO can be started, the base layer should be created from information on the older existing materials. The base layer can be created by using transaction code MRL8.

OR follow the navigation path.

SPRO –> IMG—> Materials Management –> Valuation and Account Assignment –> Balance sheet valuation procedures –> LIFO Valuation —> prepare —> create base layer.

Figure 5

As shown in figure 5, here you need to enter the materials to create base layer for and enter the LIFO method that should be used. select the values that should be used to determine the layer value, by selecting radio button, then click on execute.

2.4 Determination of Basis for comparison.

Before running a LIFO valuation, a basis for comparison needs to be determined. During LIFO valuation, the stocks are compared at a particular point in time with the total of the layer quantities. These periods are defined in the SAP system.

GJE: The stock at the end of the previous fiscal year is compared with the total quantities in the existing layers.

VOM: The stock at the end of the previous period year is compared with the total quantities in the existing layers.

VVM: The stock at the end of the period before last is compared with the total quantities in the existing layers.

CUR: The current stock is compared with the total quantities in the existing layers.

- Running a Last In First Out Valuation (LIFO) valuation

After all the configuration and preparation has been completed for the LIFO valuation, the below transactions can be executed to run the valuation.

MRL1 for a single material level

MRL2 for the pool level

MRL3 for comparison of lowest values

Figure 6

As shown in figure 6, in transaction MRL1, you can choose the LIFO method, the selection criteria and the value determination for new layer, after these settings have been entered, the transaction can be executed and the results for the LIFO valuation will be visible as shown in figure 7.

Figure 7

First In First Out Valuation

First In First Out (FIFO) is a Valuation method in which the material that is purchased or produced first is also sold, consumed, or disposed of first. Companies with materials that are batch-managed, have an expiry date, or degrade in quality over time will often use this method. With this method the next item to be shipped out will be the oldest of that material in the warehouse. In practise, this method usually reflects that underlying commercial method pursued by companies in rotating inventory.

Newer companies commonly use FIFO for reporting the value of merchandise to bolster their balance sheets. As the older and cheaper materials are sold, the newer and more expensive materials remain as assets on the balance sheet.

- Configuration

4.1 Activate LIFO/FIFO valuation.

it can be done by transaction code OMWE.

OR follow the navigation path.

SPRO –> IMG—> Materials Management –> Valuation and Account Assignment –> Balance sheet valuation procedures –> configure LIFO/FIFO METHODS —> General information —> Activate/deactivate LIFO/FIFO valuation.

Figure 8

4.2 Define LIFO/FIFO relevant movement types.

it can be done by transaction code OMW4.

OR follow the navigation path.

SPRO –> IMG—> Materials Management –> Valuation and Account Assignment –> Balance sheet valuation procedures –> configure LIFO/FIFO METHODS —> General information —> define LIFO/FIFO relevant movement types.

Figure 9

- Preparation

After the configuration for FIFO is complete, the materials relevant for FIFO must be selected using transaction MRF4.

OR follow the navigation path.

SPRO –> IMG—> Materials Management –> Valuation and Account Assignment –> Balance sheet valuation procedures –> FIFO Valuation —> prepare —> select materials.

In the initial screen as shown in figure 10, enter selection parameters and select set radio button as well as the material master and FIFO index table checkbox and then click on execute.

Figure 10

- Running a First In First Out Valuation (FIFO) valuation

After all the configuration and preparation has been completed for the FIFO valuation, the transaction MRF1 can be executed to run the valuation, as shown in figure 11

Figure 11

After the transaction has been executed, the FIFO valuation is performed for the selected materials, plant, and so on and a report is displayed as shown in figure 12.

![]()

![]()

Figure 12

Conclusion:

From the above steps, one can understood how the materials can be flagged as LIFO/FIFO, we have examined the LIFO valuation method in which the material that is purchased or produced last is sold, consumed, or disposed of first. And in FIFO valuation method the material that is purchased or produced first is sold, consumed, or disposed of first. With this now we can configure the LIFO/FIFO valuation method for your client requirement.

References:

Pre requisite: Should have Basic knowledge of materials management.

Please like, share and comment for any queries through add comment button which is displayed at bottom of the blog-post.

For any queries please post your question by using the following link

https://blogs.sap.com/tags/402489426158095572469338199787586/

Hope this blog-post will be help full

Thank you

如有侵权请联系:admin#unsafe.sh