2023-11-27 07:58:20 Author: blogs.sap.com(查看原文) 阅读量:10 收藏

The material master setup for material movement transactions in SAP is plant-specific.

Materials that are relevant for valuation are set up with accounting views and costing views. When a material is created, a Valuation Class must be assigned to the Accounting 1 view in the material master.

Valuation Classes are usually determined by accounting as this defines the G/L accounts used for material movement transactions with financial impact.

For each material movement, such as goods receipt from a purchase order, delivery of a product to a customer, or stock transfers between plants for an inventory management transaction that is relevant to financial and cost accounting, postings made to G/L accounts in the FI module will have to be identified by an accounting document. The G/L account is derived automatically from a default combination of configuration settings of material type, valuation class of material, and (in the case of split valuation) the valuation type and movement types.

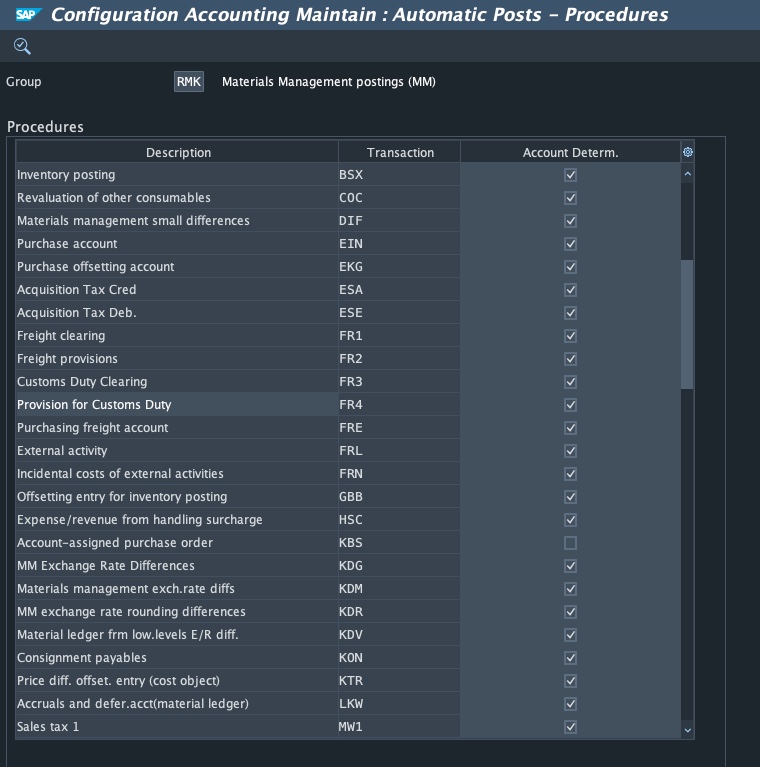

The mechanism to automatically determine the G/L account for each business transaction is called automatic account determination. This functionality can minimize the inputs and errors made by users who perform the transactions as they do not have to determine the appropriate G/L account numbers.

The automatic account determination configuration is done through transaction OBYC.

For example, the transaction BSX has these accounts configured in our system

Below are the transaction keys used in conjunction with the Material Ledger:

BSX: Inventory posting – this transaction is used for all postings to stock accounts.

PRD: Price differences – this transaction is used to post price differences that arise from material movements with a value that differs from the standard price that is set in the material master or invoices.

PRV: Price differences – multilevel – this transaction is used in the material ledger closing to post multilevel price differences to inventory or to write off differences related to the revaluation of consumptions.

PRY: Price differences—single level – this transaction is used in the material ledger closing to post single-level price differences to inventory or to write off differences related to the revaluation of consumptions.

KDV: Exchange rate differences from material ledger lower levels – this transaction is used in the material ledger closing to settle multilevel exchange rate differences to inventory or to write off exchange rate differences related to the revaluation of consumptions.

UMB: Price difference from inventory revaluation – when a new standard cost is released, the system writes the results of the new cost estimate to the material master record as a current standard price.

The standard price is then active for financial and cost accounting and it is used to value the material until the next time a standard cost estimate is released. When updating the new standard price (releasing of cost estimate), materials with an on-hand inventory balance are revalued once the new standard cost is released. As a result, the new inventory balance is the new unit standard price multiplied by the total quantity. The difference between the new inventory balance and the previous amount creates a revaluation, which is posted to the account assigned to the transaction key event UMB (Gain/loss from revaluation).

Postings related to inventory revaluation originating from the release of a cost estimate are cleared from the UMB account when the material ledger for the previous period is closed. That means the amount posted to this account is transferred back to inventory to determine the actual unit cost and then it is offset against transaction key PRY.

Therefore, the balance of the UMB account related to inventory revaluation should always be zero at month’s end.

The UMB transaction key is also used with debit and credit postings using transaction code MR22.

However, in this situation, the balance on the account is not cleared out at month’s end; only the offsetting account, PRD transaction key, gets cleared. You may need to create a journal entry to adjust the balance from this account depending on the transaction you are trying to adjust.

AUM: Price differences from stock transfer – this transaction is used to post price differences that arise from materials with different valuations when doing material-to-material transfers or in transfer postings that involve two plants when a complete value of the issuing material cannot be posted to the value of the receiving material. The receiving material will carry the variance.

This applies to both materials with a standard price and materials with a moving average price control.

GBB-AUI: Activity price revaluation – this transaction is used to post the over/under absorption of a manufacturing cost center. This revaluation occurs during the actual costing run posting. The variance is allocated proportionally to its corresponding materials based on the quantity that was absorbed from the cost center to the production orders in the course of the month through an activity type or business process.

COC: Revaluation of other consumables – this transaction is the account used to post price differences related to single-level consumption not revalued using the original cost element. The calculation of this revaluation is done when performing the “revaluation of consumption” step in the Actual Costing run at month’s end.

WPA: WIP from activity price differences – this transaction is used to post the material ledger revaluation from the WIP revaluation step on the actual costing run. These are price differences from the actual price calculation of activity type or business process that are to be assigned to the work-in-process inventory.

WPM: WIP from material price differences – this transaction is used to post the material ledger revaluation from the WIP revaluation step on the actual costing run. These are price differences related to material consumed to process orders that are still in process and are to be assigned to the work-in-process inventory.

LKW: Accruals and deferrals account in material ledger – this transaction is used when you choose not to revalue the ending inventory values with the material ledger variances (price and exchange rate differences). Instead, all price differences are posted to this account. In countries where actual costing is a legal requirement, this transaction key should not be maintained.

Defining Movement Type Groups of Material Ledger

You define movement type groups for the Material Ledger and define how consumption is to be revaluated with these movement type groups.

Controlling ® Product Cost Controlling ® Actual Costing/Material Ledger ® Material Update ® Define Movement Type Groups of Material Ledger

Assigning Movement Type Groups of Material Ledger

During consumption of revaluation, the consumption items with above movement types that are assigned with CF or CC are to be revaluated using the original consumption account. With CC assignment, the CO account assignment of the original goods issue is revaluated too. Those remaining consumption items will be revaluated on a collective account that is defined in transaction COC (Revaluation of other consumables) in OBYC.

Thank you for your time, I hope this post is helpful.

如有侵权请联系:admin#unsafe.sh