2023-11-17 22:31:56 Author: blogs.sap.com(查看原文) 阅读量:8 收藏

In this blog, I would like to demonstrate the posting for Event-Based Revenue Recognition – Project-Based Sales (4GQ)

This scope item is linked with Project Control – Sales (4I9)

As Sales Order Item is not a cost object in S/4HANA Public Cloud, if customer have used SO Item as a cost object to collect additional cost outside of manufacturing process in ECC6, the way to move to Cloud is to use WBS or Service Order as a cost object to collect cost that incur instead. With WBS, we can WBS with Sales Order Item by assigning WBS number in Sales Order Item which will be shown in this blog.

In this blog, I have used the Recognition Key EPMCC since I want to have WIP (Deferred Cost) for the cost that incurred in the WBS until project is completed.

Also, I skip the billing and defer revenue from the sales order (step 2 and 2a in Figure 1 below) since this is already shown in another blog – Event Based Revenue Recognition – Sell from Stock (1K2)

Figure 1: posting logic behind the revenue recognition key EPMCC

For other Revenue Recognition key, you can refer to our SAP Help Portal

System Demo

Please note that the number in this screenshot is not the same as the Figure 1 posting scheme above.

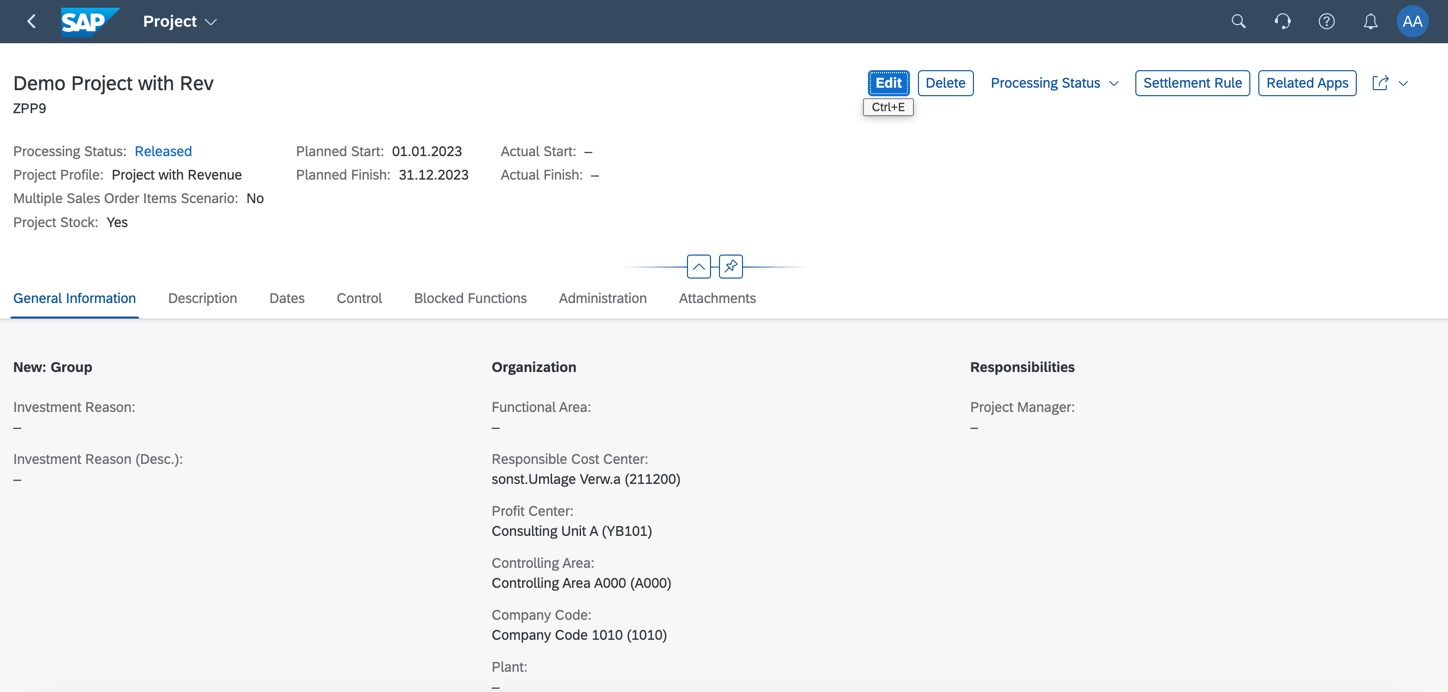

First, we have created Project ZPP9 and then 2 WBS under the same project as we plan to link 1 WBS : 1 Sales Order

Figure 2: Project Definition

There is a possibility to also have multiple sales order in 1 WBS by setting the Multiple Sales Order Item Scenario. However, this indicator can only be tick or untick during the time of project creation. (There is a warning popup ‘Multiple Sales Order Items Scenario flag can be set on first save only.’)

However, in this blog, we will not use this option as we want to have 1:1 between WBS and Sales Order.

Figure 3: Multiple Sales Order Indicator

After created the project, we created 2 WBS – ZPP91 and ZPP92

Figure 4: Project Planning

Now, in WBS ZPP91 and ZPP92, we need to make sure that the billing element indicator is ticked and also specified the Recognition Key since this will impact how event based posting scheme

Figure 5: WBS Setting

After we have created WBS and then release them, next step is to create the Sales Order and then assign WBS in Sales Order Item

Figure 6: Sale Order Item – Account assignment

Our second sales order, Sales Order Item account assignment assigned with second WBS

Figure 7: Second Sales Order

After both Sales Orders are created, system updated the sales order in each of WBS automatically.

Figure 8: WBS is now updated with Sale Order Number

Then we post activity allocation into these 2 WBS

Figure 9: Direct Activity Allocation

After saving this activity confirmation, system automatically created 4 documents as follow:

Figure 10: List of Journal Entries

As you can see here in Figure 10, system created Revenue Recognition Document (Doc Type RR) together with the normal CO Document.

This is the details of the CO Doc below. You can see that system automatically posted the Sales Order number that linked with WBS even though during our activity allocation, we did not input any sales order number – we only input WBS number.

Figure 11: CO Document

Here is the Revenue Recognition Document – as our Recognition key is EPMCC, all the cost in WBS will remain in WIP until the project is complete

Figure 12: Revenue Recognition Document

Now, if we check Project Cost Line item, here is what we will see – so we can see the WIP in WBS and also Sales Order number

Figure 13: Project Cost Line Item Report

Now, let us try to complete the project.

Figure 14: Complete The Project

We can review the project document in Event-Based Revenue Recognition – Projects app.

Figure 15: Event-Based Revenue Recognition – Projects App

We can try to simulate what system will post – as project is now finished, the Deferred COS should be cleared to zero.

Figure 16: Simulate of the Revalue

Now, we can also try to monitor if there is any issue by checking in this Manage Real-Time Revenue Recognition Issues app

Figure 17: Manage Real-Time Revenue Recognition Issues

If there is no error, we can proceed to Run Revenue Recognition job

Figure 18: Run Revenue Recognition – Project Job

Figure 19: Job is Finished

Check the Job Log

Figure 20: Revenue Recognition – Job Log

Then check the job result

Figure 21: Revenue Recognition – Job Result

Last step after the revenue recognition has been posted, we go back and run the line item report again. Here we can see that the WIP is now cleared out from WBS.

Figure 22: Display Line Item Report

Revenue Recognition Setting

The accounts that system post from event based can be setup in CBC Maintain Settings for Event-Based Revenue Recognition (SSCUI 102530)

Assign Source Cost Element first

Figure 23: Source Cost Element

Then assign Posting Rule

Figure 24: Posting Rule

Hope this blog give you visibility of how is posting of Event-Based Revenue Recognition – Project-Based Sales (4GQ) looks like.

There is also a very useful blog: An Introduction to Event-Based Revenue Recognition with Customer Projects in SAP S/4HANA Cloud from Stefan Walz

Final Note, I would like to say special thanks to Primoz Penko and Svetlana Yancheva for preparing this testing together.

如有侵权请联系:admin#unsafe.sh