2023-11-17 16:28:22 Author: blogs.sap.com(查看原文) 阅读量:7 收藏

Hi,

Not sure whether this is your first visit to our update blog. In any case great to see you here. Let me walk you through some of the key innovations delivered with SAP S/4HANA Cloud 2308 and S/4HANA 2023 that are relevant for finance professionals, and why.

Referring to our 2022 update, introducing the key innovations supporting organisations around the world to transform their business including their finance organisation we started from the three pillars where we make the relevance of our vision clear to these organisations – including yours – enabling you to become intelligent and sustainable, bringing enterprises together into a global Business Network and support creating a sustainable world together.

Particularly for finance professionals, they play a key role in

- Transforming their business in a financially viable & risk-adjusted way

- Ensuring complete transparency and optimization in how and where value is created through their global supply chain, while keeping a close look at tax and trade regulations

- While putting everything in the perspective of the sustainability outcomes are set by their organization.

While these key focus areas remain stable, we have clearly seen an increased interest in next generation automation including – but surely not limited to – new forms of artificial intelligence and business user usability within not only operational finance but business steering as well. The one additional area which cannot be left behind is the exponential growth is the focus on sustainability which more and more resides under the responsibility of the CFO. Not just because of regulatory requirements, but as an increasingly important dimension in decision making as well.

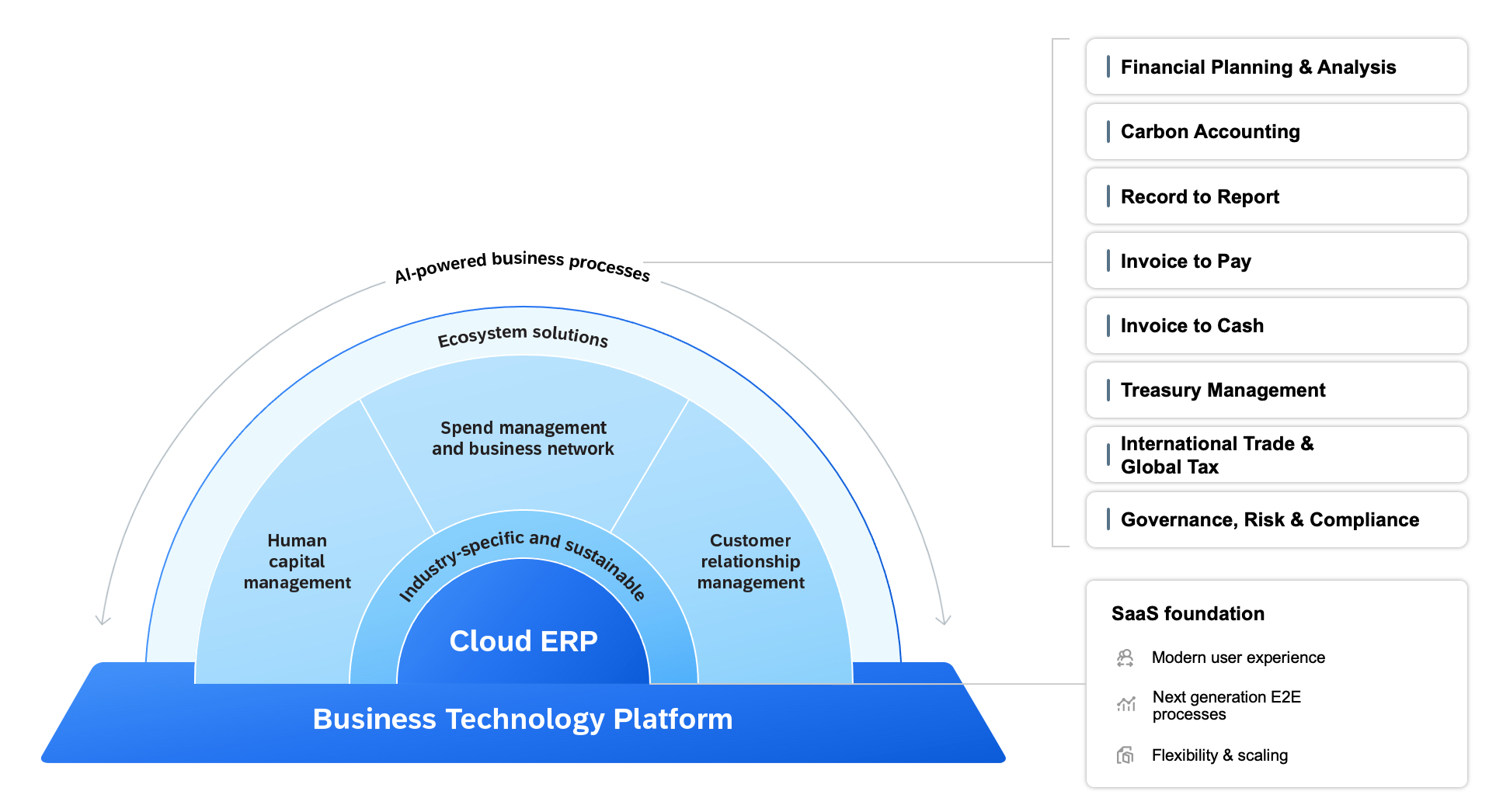

This is why, for this update on S/4HANA Cloud related deliveries in 2023, specific attention is put to the underlying value of the modular, cloud-based technological baseline.

While we keep on investing in the end-to-end processes within our core S/4HANA Cloud application, our business technology platform is the baseline for an increasing number of innovations SAP delivers in the area of automation as well as analytics.

First and foremost by using the business technology platform (that’s BTP in short) to build out of the box solutions… from very specific applications like advanced financial closing all the way to SAP Datasphere, within which we have created a finance foundation, which basically is a core finance datamodel, I ’ll get back to later.

On top, BTP is also the development platform that can be leveraged to extend the capabilities delivered within the core solutions. Think , as an example, of developing specific intelligent robotic process automation to upload manual postings , or a workflow to approve a particular type of accrual or payment. Dozens of these have been delivered already… and more can easily be created in a low-code, no-code approach using SAP Build Process Automation.

While making finance transformation a reality these days can hardly be imagined without technology, the way to realize it should still start from the business processes. So let’s take this process focus to guide you through some key innovations.

Starting with the area of financial planning & analysis, a key driver for the latest innovations is the goal to support FLEXIBLE strategy definition AND execution by stepping up from periodic planning to ad-hoc, driver-based what-if analyses.

Examples of innovations driving this include:

- the extension of pre-delivered business content, through the addition of commercial planning, connected to content in other lines of businesses that were already available.

- an important step in delivering an end-to-end working capital dashboard as a first deliverable based on a complete foundational finance datamodel within SAP Datasphere… which will serve as a common basis for other dashboards to come, directly integrated with the transactional information from SAP S/4HANA Cloud. The updated solution profitability dashboard which also has just been released is another interesting example on how this finance foundation can be leveraged.

A second driver of innovation within the FP&A space is to enable organisations to understand the root cause of financial performance across the entire organisation, based on increased confidence in business plans and insights within an ever-changing reality.

This has been materialized in innovations like:

- A new, flexible way of defining and updating market segments within SAP S/4HANA Cloud Margin Analysis and the evolution of the ledger-based accounting principles.

This ledger-based approach is what we earlier introduced as UPA or universal parallel accounting, a fundamental financial architectural change which we definitely have not seen the last aspect of. - the inclusion of profit center transfer prices in the ledger approach, supporting divisional reporting and allowing profit centers to trade at arm’s length.

On top of these evolutions, let’s not overlook the evolution from financial to enterprise value reporting and analysis, which includes sustainability data on top of the traditional financials.

While the latest release SAP S/4HANA Cloud, both public and private edition does not deliver an end-to-end sustainability solution at this stage, it is worth to mention that, based on universal parallel accounting, SAP has clearly taken the direction of treating carbon very similar to monetary – let’s say classic financial – values whereby financial accounting practices are the blueprint for carbon accounting going forward… very much in line with how the International accounting standards board and the International Sustainability Standards board Chairs see this.

From a solution perspective, this will lead to one, central “General Ledger for Greenhouse Gas emissions” based on Journal Entries posted on accounts in finance quality to financial dimension. Thus supporting reporting of emissions embedded into financial reporting steering emissions in line with financial steering.

This topic will be dealt with in more detail in a separate update in due time… and you can get a glimps on it in our update video focusing on cash and treasury as well.

Mentioning financial accounting seamlessly brings us to our next area of innovation: the evolution toward autonomous, event-based finance processing, within the financial accounting and closing area as well as in how we can deal with payables and receivables.

Starting with entity closing, multiple enhancements have been delivered Improving entity closing process governance with full visibility of validations.

These include:

- New SAP Fiori apps to maintain and execute financial closing validations such as balance verifications

- Automated supervision of closing tasks with account balance validation

- BlackLine Integration offering a risk-based approach for auto-certification of certain balances and central storage of supporting documents and certifications for easy audit

- Furthermore let’s not forget the ability to extend closing task automation with SAP Build Process Automation,

- All Integrated with SAP S/4HANA Cloud for Advanced Financial Closing to further automate execution and trigger prompt actions in case of failures

To get a better understanding on the value SAP Build Process Automation Could bring, have a look at this short video.

An update on SAP S/4HANA Cloud or Advanced Financial Closing can be found here:

Stepping up to the group close, SAP’s strategic consolidation strategy remains SAP S/4HANA Cloud for Group Reporting, which – to a certain extent and depending on the specific arrangements – is also included in the S/4HANA license, both in public as well as private cloud. While innovations are added here as well, I’d like to mention we’ve improved and extended the capabilities to capture data from different source systems, for which the so-called Group Reporting Data Collection.

Unlocking new efficiencies in the execution of finance processes is – of course – not limited to core accounting and the financial close. It is at least as crucial when dealing with payables and receivables.

Many capabilities have already been delivered to ensure focus is set on business-critical activities which serve at optimising working capital. Data driven receivables management is just one example. But through further process orchestration, workflow and AI capabilities SAP is taking intelligent automation again a step further. For example through the delivery of approval workflows for supplier down payment requests, or by making use of generative AI within the receivables collection process. An example which – while planned to be delivered later on this year – shows the importance of a cloud-based architecture. Automatically extracting business information out of emails, automation of case documentation and generating written response proposals require system learning from data points well beyond the core ERP solution alone.

And of course… needless to say that different business models lead to different ways to handle receivables. Which brings us to the innovations in subscription business management. A dedicated video provides you more details on all relevant aspects from pricing, entitlement management to cash collection. Allow me to simply point out the increased flexibility in subscription-based offerings as well as the management of payment terms.

SAPs public cloud solution SAP Subscription Billing helps to set up and handle subscription contracts throughout the entire subscription lifecycle.

Also new features are available for intercompany settlement for usage and subscription services, within public cloud.

In the end… all purchase and sales transactions lead to a cash event, which brings us to the topic of cash and treasury management.

With SAP S/4HANA Cloud 2308 and S/4HANA 2023, recent enhancements have been added further supporting organisations to automate payments, manage liquidity, and mitigate the different business risks.

I already referred to the working capital dashboard leveraging the data directly from the core S/4HANA Cloud environment through the finance foundation delivered with SAP Datasphere. But there ‘s much more … from payment management innovations to bank statement processing.

Business risks as well as regulatory requirements go well beyond the area of finance alone… which brings us to the broad domain of Governance, Risk and Compliance. Again an area with multiple innovations to talk about.

Starting with risk.

While it would never happen in a perfect world, in reality organizations are increasingly surprised when their business applications are compromised, and the company loses data, or the business is affected by data manipulation or manipulation of business processes. All because the increasing number of targeted cyber-attacks. That’s where SAP enterprise threat detection comes in, including important new capabilities delivered with SAP S/4HANA Cloud 2308 and S/4HANA 2023, which are covered in more detail in a dedicated video as well.

We mentioned the exponentially increasing impact of sustainability overall… and this definitely is also a key point from a legal compliance perspective. But there ‘s clearly more to compliance.

That’s why we’d like to also draw your attention to key innovations delivered within SAP Financial Compliance Management, SAP Document and Reporting Compliance, and tax-related enhancements for Indirect Taxation Abroad (also known as RITA). As it would lead is too far to include all relevant elements here and now, let me, once more, guide you to a specific more elaborate explanation of key innovations:

As you can see, these innovations delivered with SAP S/4HANA Cloud Public Edition 2308 and S/4HANA 2023 are instrumental to empower CFO and the entire finance team

through our modular business steering platform combining analytics, prediction and risk,

enabling reimagined processes leveraging intelligent technologies,

supporting industries’ agile transformation of their go to market & supply chain,

based on a unique business foundation, sustainably & resiliently,

thanks to the Cloud.

I hope you ‘ll enjoy the additional deep dives into our innovations provided in a series of additional topic specific update videos.

如有侵权请联系:admin#unsafe.sh