Hello,

sharing with you a solution for displaying the Gross Salary in the Compensation section so you can use it again in ECP and document generation.

The Requirement:

- In Most of organizations and for legal requirements Official HR Documents Like HR Letter, Employment Contract and so on, it is mandatory to have the agreed Gross Salary amount including the insurance and tax.

- Also the Payroll system use the gross salary in the calculation.

The Gross Salary here mean the localized gross salary .. means the Net Salary + insurance amount calculated based on the insured salary + tax .. all this calculated according to the local insurance and tax law

The Challenge:

This feature is not available out of the box in SuccessFactors Compensation section or Document Generation and you cannot find in Business Rule Engine a function that converts Salary from Net to Gross.

The blog post explains a solution to display Gross Salary automatically in the compensation section

Gross amount in Compensation Section

Solution in brief:

- Creating a lookup table to map the number to equivalent gross (Custom MDF Object). The MDF includes the net amount and the equivalent gross amount.

- A business rule using (Lookup) function to return the gross of the net.

Solution Implementation Description:

Before starting solution implementation you have to consider the following points

- Discuss with the Customer the number ranges of current salaries and the expected increases in the coming years

- The solution is built based on an assumption that there is a good knowledge of document generation function as it will not get deeper in document generation steps

Step 1:

Create a custom MDF object (i.e. NettoGross) as a lookup table contains the following fields

- Net (Type Should be “Number”)

- Gross (Type Should be “Number”)

Note: you need to enable the effective date .. so you can update the tables with effective date in case of change in the law

Gross Up Custom MDF

Step 2:

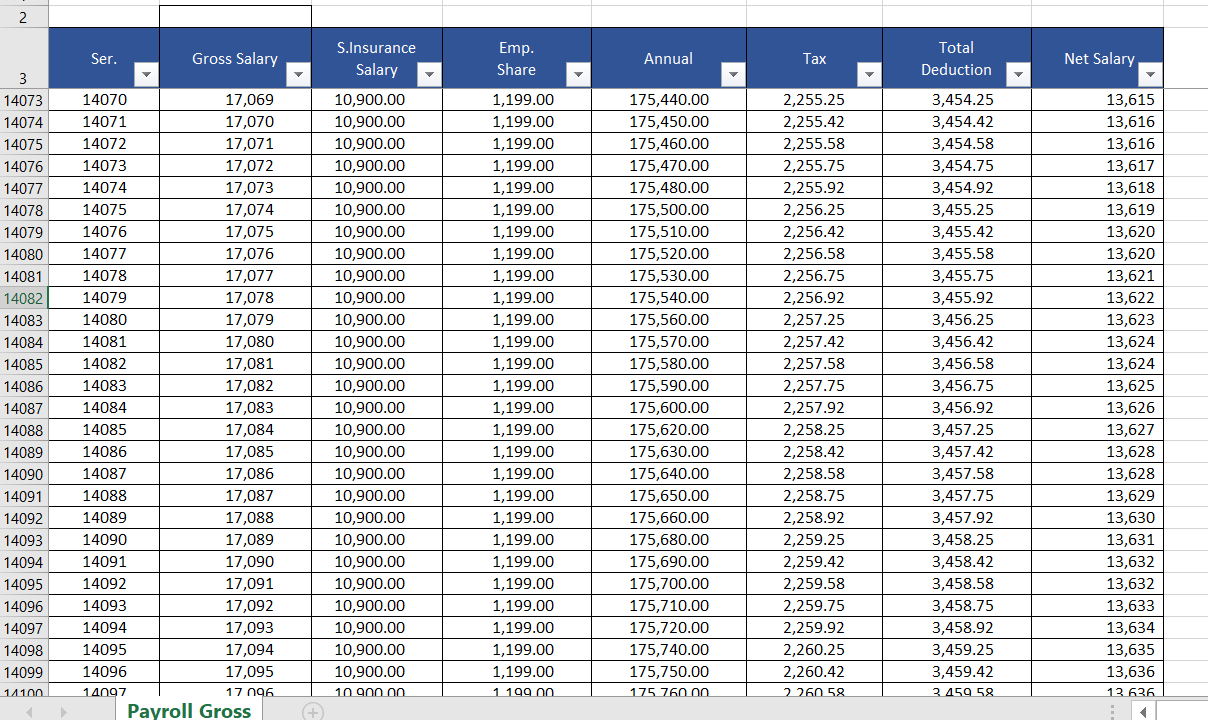

Prepare an excel sheet include all the following component and equation (you can ask for help from the payroll specialist) :

- Gross Salary Component: This is the column you will inter it, start from the minimum salary as per local law and increase it with one unit up to maximum salary for Example: from 3000 Pound as a minimum salary increase it with one pound 3001, 3002, 3003 up to 1,000,000 .. you can divide this up to 10 different sheets to avoid the heavy loaded sheets

- Social Insurance Salary: This is the equation which will calculate the Social insurance salary as per the local law

- Employee Share: This is the equation which will calculate the Employee Share amount

- Tax: This is the equation which will calculate the amount of tax as per the tax law

- Total Deduction: Sum equation which will sum all the deductions

- Net Salary: this is the equation which will get the net salary as per the calculated deductions

Calculations Excel Sheet

Step 3:

Prepare a CSV file to fill the lookup table with the Net and Gross then upload the file.

CSV File

Step 4:

Now it is time to write the rule to populate the Gross of the Net Amount. The rule simply lookup in the MDF object created in Step 1 getting the equivalent Gross of the amount of all pay components included.

Lockup Rule

Hope you enjoy the process

Thanks

A.Aranda

如有侵权请联系:admin#unsafe.sh