2023-10-10 22:14:42 Author: blogs.sap.com(查看原文) 阅读量:13 收藏

In this blog we will focus on several fields in GL master data which are important to consider when you are harmonizing the chart of accounts in SAP central Finance.

Lot of time I get questions from business/consultants as how we should define field status, how should be manage open item indicator or tax indicator. This blog should serve as comprehensive guide and of course the scenarios change per project/per customer so use it as a guidance not full-fledged solution.

Lets first list down the fields which needs to be managed in GL master data

We will discuss each item now in detail.

1. GL Account Type – This field has to be consistent across source & target systems.

-

- Balance Sheet Accounts map to Balance Sheet Account in CFIN

- P&L Account without Cost Element in source map to Nonoperating Expense or Income account in CFIN

- P&L Account with Cost Element in source map to Primary Costs or Revenues Account in CFIN

- Secondary Cost Element map to Secondary Costs Element (when Source system is a S4 system)

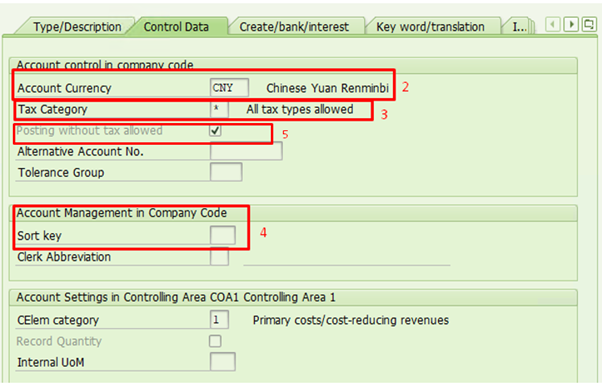

2. Account Currency – Below combinations should be managed

3. Tax Category – The Tax category determines whether the following apply to the G/L account

-

- Is it tax-relevant?

- Is it a tax account?

The recommendation is to set the tax category in target system more or less similar with the source system. If this is not possible or the landscape have multiple source systems with differences then, the settings in CFIN needs to be more permissive than the one in source system. See below table for more details

4. Sort Key – Any value coming from source system is the leading value. CFIN will update this field if its coming as blank from source or any intervention is done via BADI.

5. Posting without tax code allowed – Indicates that the mentioned account can still be posted to even if a tax code has not been entered. If tax code is not entered during posting to this account, the system checks the entry against the tax category. Below settings are allowed

6. Field Status Group – This needs to be determined based on customer processes and requirement however it is important to note that the group on CFIN side needs to be more open. Like if any field is optional in source it can be mandatory in target (technically) but it will lead to error as that field may come blank in transaction since user is not forced to update that. Options can be

-

- Create the Field Status Group in Central Finance exactly as in source system

- Setup all fields as optional in CFIN (relevant if CFIN is reporting system only)

- Harmonize and map the Field Status Group from source systems to the Fields Status Groups in Central Finance system

7. Post Automatically only – This indicator can be selected for accounts such as for withholding tax accounts, GR/IR clearing accounts, all sales tax accounts, discount accounts, consumption accounts, etc. During replication of documents this indicator has no impact. Its usage is important during document entry (which is done is source system) and not during document reposting, as the account determination was already executed

8. Open item management – Open Item Management allows effective control and traceability of the document chain representing the same business transaction. Items posted to accounts managed on an open item basis are marked as open or cleared. The balance of these accounts is always equal to the balance of the open items. Below are allowed/not allowed

9. Open Item management by Ledger Group – Standard “Open Item Management” indicator does not accept ledger specific postings and this indicator is relevant if Parallel Accounting using Ledger Approach is implemented. The indicator “Clearing Specific to Ledger Group” needs to be activated for the accounts that need to be managed as open items and are used in postings to specific ledgers If you set this indicator, it replaces the “Open Item Management” indicator, which consequently you will no longer be able to set for the same account. This indicator CANNOT be set for the following accounts:

-

- Goods receipt and invoice receipt accounts

- Accounts for cash discounts

- Reconciliation accounts

- Tax-relevant accounts

- P&L accounts

- Company Codes that have only one ledger active

- Automatic Postings

- Supplement for Automatic Postings

share your relevant experience specially when you have mix of source systems.

如有侵权请联系:admin#unsafe.sh