2023-10-10 16:45:7 Author: blogs.sap.com(查看原文) 阅读量:8 收藏

Finance teams are being asked to do many new things – build a digital strategy, provide guidance to the business on new opportunities, execute on mergers, acquisitions and divestitures with increasing frequency, formulate an opinion on the applicability of new technologies like generative AI.

Each of these tasks could easily fill the week’s working hours. This means that many classic (manual) accounting tasks in the record-to-report process are performed under more time pressure. An alternative approach would be to rethink the process, taking advantage of the automation capabilities in the SAP S/4HANA Cloud solution.

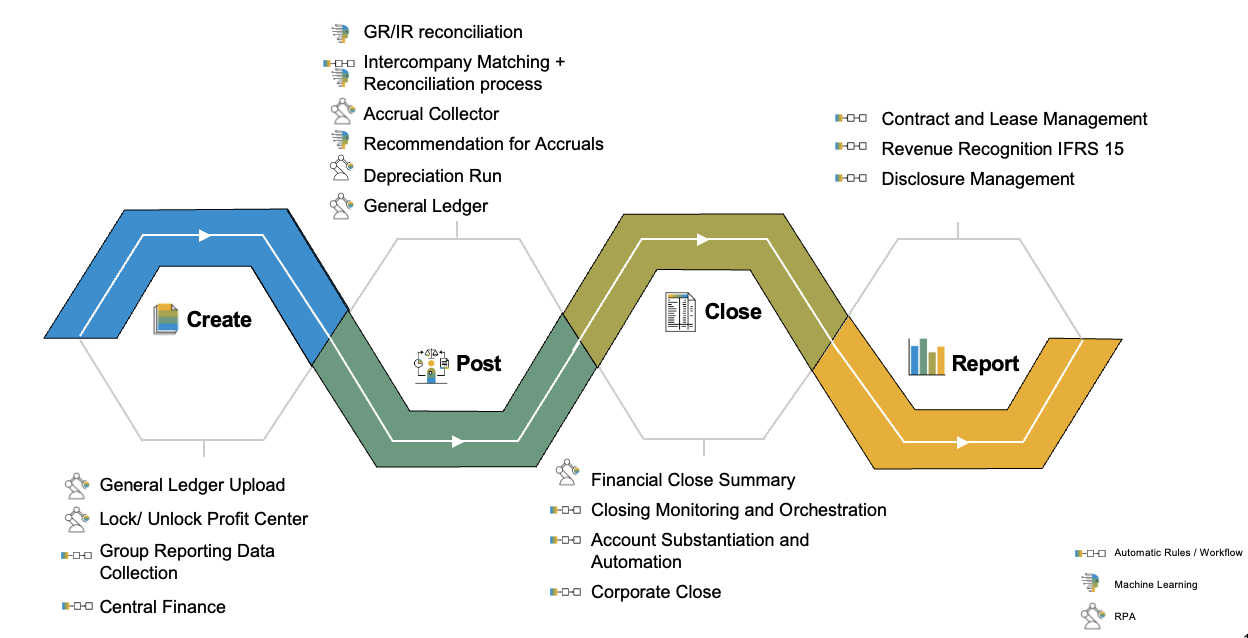

The process flow below shows the automation potential in record-to-report, supported by SAP technology. The icons reflect three kinds of automation:

- Automatic rules / workflow: The power of this old-school AI should not be underestimated. SAP has been using this approach for 50 years – taking best practice approaches and making them available in our core processes. An effective rule-based approach can achieve a high degree of automation, and coupled with workflow, this can really keep processes moving.One significant change to rule-based processing in recent releases is giving the tasks of rule-building to business users. In ECC releases, consultants were often needed to update rules. In the intercompany matching and reconciliation solution in SAP S/4HANA Cloud, however, the business owner owns rule creation, making it easier to adjust rules as business practices change.

- Machine Learning: This AI method uses historical data related to business situations and their resolution to generate a model that performs a similar task on new data or transactions. An example is the reconciliation process for goods and invoice receipts, where the system performs the reconciliation and suggests next steps and postings based on previous actions performed by accountants. The accountant then is a reviewer – or they can move to a manage-only-the-exceptions approach.This approach is most effective with business processes that have a large quantity of data, so that the trained model is as robust as possible. It can also be used after a rules-based approach is applied on the remaining data, as is the case in intercompany matching and reconciliation.

- RPA (Robotics Process Automation): This approach uses bots to perform tasks in the system that would otherwise require some manual intervention. These bots can reduce human errors, and because they can be scheduled to run, they can help teams gain speed and efficiency.The SAP approach is to deliver bot content via the store that customers can use as an alternative to APIs, web services and classical connections. These bots have pre-defined hooks into the business process and offer a more stable approach that many homegrown bots that work on the user interface only.

R2R Automation

How much automation is really required? This is really up to each finance team and their intended business focus. But for most teams, even as their business grows, they are expected to scale their existing resources. And automation capabilities are one way of doing this without asking your teams to work beyond their standard working hours.

Where can I learn more about these possibilities? help.sap.com and the SAP partner community are a great place to start!

如有侵权请联系:admin#unsafe.sh