2023-10-4 16:48:10 Author: blogs.sap.com(查看原文) 阅读量:25 收藏

In this blog the focus is on Tax aspects with reference to SAP Central Finance. With the implementation of SAP Central Finance what are the areas impacted or should be take care which are tax relevant like tax codes, tax reporting, tax engine, Deferred taxes, Withholding taxes etc.

We will cover below in this blog:

- Indirect Taxes

- Mappings needed

- Consistency check

- VAT recalculation check

- External Tax Engine

- Plant Abroad

- VAT Return

- Official Document Numbering (ODN)

- Withholding Taxes

- Introduction

- Use cases

- WHT Tax code and Tax Type mapping

- W and W/O Accumulation

- WHT consistency check

- Deferred taxes

- Central Tax Reporting

Indirect Taxes

The taxes which generally come in the form of VAT, GST or Sales Tax. In the very first step of Central Finance Foundation phase the tax data needs to be mapped between source & target system.

In CFIN it will always be Tax Procedure based on country and tax code for calculations under tax procedure while in source system it depends on system type. If its SAP system them you can map tax tax procedure and tax codes between the systems however if the source system is non SAP then the transformation of data needs to be done in order to derive right tax code in cFIN. For non SAP systems the SLT staging tables only support 2 character tax codes so all source data from source needs to be mapped in right way.

SAP to SAP system – Example below

Tax Procedure Mapping

Below can be the options

- 1:1 – keep same tax procedure in CFIN as in source

- N:1 – harmonization due to same country present across multiple source systems

- 1: N – in case source has a unique tax procedure (like TAXEU) with multiple tax procedures combined based on legal requirements

It is recommended to use standard SAP delivered tax procedures in SAP S/4HANA Central Finance per country

Tax codes mapping

Non-SAP to SAP system – Example below

| Source System | Tax calculation | Target System | Tax Code |

| JDE | TAXFIVEPERCENT | S4HCLNT100 | V5 |

| ORACLE | 5 % Input tax | S4HCLNT100 | V5 |

*Tax procedure will be derived in cFIN based on country of the company code.

Before the Initial Load is done the consistency checks should be done for tax related items.

READ HERE more about consistency checks in central finance

VAT Recalculation Check

When postings are replicated to Central Finance, the system recalculates tax values based on the configuration of the Central Finance system and compares the expected outcome with the replicated values to be posted and issues an error if a significant difference is detected. This check has to be specifically activated as below and can be done without central payment also.

Prerequisites for this check:

- The tax code must be configured with the indicator Error Message for Invalid Tax Amount (field label Check-ID) set (T007A-PRUEF = ‘X’).

- In addition, an appropriate tolerance must be configured for the Tolerance Percentage Rate for Tax Calculation. This tolerance percentage rate defines, for the tax code, the percentage rate which is accepted as tolerance between a calculated value and a value which was replicated. This setting also applies to the values which are entered for documents posted directly in the Central Finance system. The Tolerance Percentage Rate for Tax Calculation must be set to check the value strictly, that is, as close to zero as possible.

Exclusions from this check

External Tax Engine

- External tax engine is only supported for USA, Canada and Puerto Rico (SAP note 1497956)

- External tax engine must be certified for Central Finance Scenarios in S/4 HANA.

- Thomas Reuters: ONESOURCE Indirect Tax Integration

- Vertex Indirect Tax

- Taxware

- Sovos Global Tax Determination

- External tax engine should be identical between source system and Central Finance system.

- Technically you can connect multiple Tax engines in CFIN: exactly one tax engine per supported country (country and tax procedure is 1:1 or n:1 cardinality)

Plant Abroad

Below scenarios are supported/Non Supported. This is mainly relevant for EU countries

VAT Return

During Initial Load the Open items are transferred without any tax information and without the other line items (income and expense). Therefore following should be noted:

- Central Finance does not support tax reporting for those periods of the initial load for which only balances and open items are transferred. For these periods, tax reporting must be done out of the source system and must be completed before you start reporting taxes out of the Central Finance system. Central Payment must not be activated until this task has been completed.

- If tax reporting is carried out based on selection via posting date (BUDAT) or tax reporting date (BKPFVATDATE) then, once you have transitioned to central tax reporting, you should not make retrospective postings into the periods which were covered by the initial load of open items and balances only.

During replication phase it classifies as before and after central payments.

Before Central Payment is activated, the report for Advance Return for Tax on Sales/Purchases and payment to the tax authority must be processed in the source system. After Central Payment is activated, the process depends on whether the company is in a country where it is legally required that short payments generate tax adjustment:

- If you are in a country where short payments to suppliers/from customers (such as cash discount) do not generate tax adjustment, the report for Advance Return for Tax on Sales/Purchases can be run either in the source system or the Central Finance system. While the payment to tax authority must be executed in the Central Finance system.

- If you are in a country where short payments to suppliers/from customers (such as cash discount) generate tax adjustment, both the report for Advance Return for Tax on Sales/Purchases and the payment to tax authority must be executed in Central Finance system.

- For historical open items on tax payable account, the payment to the tax authority must be processed in the Central Finance system

Official Document Numbering (ODN)

Central Finance does not currently support the concept of official document numbering. Consequently, tax reporting for countries (like Italy, Romania) where official document numbering is a legal requirement is not supported. This has to be handled in a custom way

Withholding Taxes Introduction

- Central Finance supports Extended Withholding Tax only. In all source company codes, for which withholding taxes shall be replicated to the Central Finance system, Extended Withholding Tax must be activated in the respective source system

- Withholding taxes are calculated in the source system and transferred to the Central Finance system exactly as they are posted in the source system. They are not recalculated in the Central Finance system. Please make sure that the withholding tax configuration in your source system(s) and the Central Finance system is semantically the same, even if various Customizing codes are different and require mapping.

- Certificate numbers are always generated in the Central Finance system. For this reason, you need to make all required settings for WHT certificate numbering in the Central Finance system

- If you have activated Central Payment for a certain source company code, you post documents centrally with tax impact in the Central Finance system that are not available in the source system. That is why you must also do the tax reporting in the Central Finance system. This applies to all taxes including withholding taxes

Use cases

- Withholding taxes posted at the time of invoice (ongoing replication)

- Withholding taxes posted at the time of payment (ongoing replication)

- Withholding taxes in reversal documents

- Withholding taxes within document changes

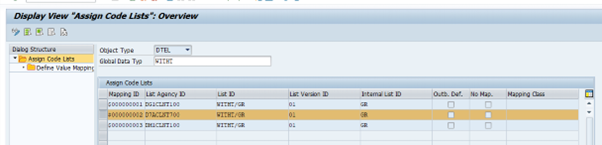

Withholding Tax Codes and Tax type mapping

When transformation of data is done from source to target the mappings will be needed for WHT code and WHT Type

Withholding taxes with and without Accumulation

If withholding taxes (WHT) without accumulation are used then Central Payment can be activated and start preparing the WHT reporting in the Central Finance system.

If withholding taxes with accumulation are in use and wish is to activate Central Payment, then business should first analyse the business processes and decide carefully, whether and when the Central Payment function shall be activated. Accumulation data are not replicated to the Central Finance system. It depends on the tax types used, on the point in time at which the accumulation is done, on whether Central Payment is active or not, whether the accumulated withholding taxes are available in the Central Finance system. Below the scenarios possible are listed.

Withholding tax Consistency Check

Deferred Taxes

Deferred taxes are taxes that are not yet recognized when an incoming or outgoing invoice is posted, but only when a payment is made.

When an invoice is posted , special deferred tax codes is used and the tax amount is posted on special deferred tax accounts. After payment the tax amount is reposted with a tax transfer document to the regular tax account.

The initial load of open items includes now complete journal entries with deferred tax codes during the open item and the balance phase. Deferred tax processes can be executed in the Central Finance system

Tax reporting can be done in the Central Finance system and Central Payment can be activated for countries where the deferred tax process is required. Deferred Taxes are supported in the Central Finance scenario with a few restrictions

During Initial Load – Open items are transferred without any tax information the entries in the DEFTAX_ITEM table could not be created correctly in the Central Finance system. After Initial Load the report RFINS_CFIN_CORR_DEFTAX_ITEM needs to be executed

During replication – there are not all DEFTAX_ITEM entries correctly created in the Central Finance system. To make the correction below reports needs to be executed

- RFUMSV50

- RFUMSV53

Central Tax Reporting

In order to centralize the finance processes it is important that we don’t forget about tax reporting. With central finance the tax reporting can be centralized.

SAP supports tax reporting for several countries via central Finance. In addition to finance data there is a need for logistics data in Central Finance to support the tax reporting for some countries and this can be met via AVL. Read here in details about AVL.

Tax reports (only few are listed) which are available via DRC (previously known as ACR) – READ HERE more

- Pro-Rata adjustments due to PR variation

- Print Program: Advance Return for Tax on Sales/Purchases (Germany)

- Additional List for Advance Return for Tax on Sales/Purchases

- EC Sales List in Data Medium Exchange Format

- Pro-Rata adjustments due to PR calculation

- Advance Return for Tax on Sales/Purchases

- VAT Refund

- Tax Adjustment

- EC Sales List

share your experience via comments related to what other challenges you faced in managing tax related expectations from the clients and what unique scenarios were there..

如有侵权请联系:admin#unsafe.sh